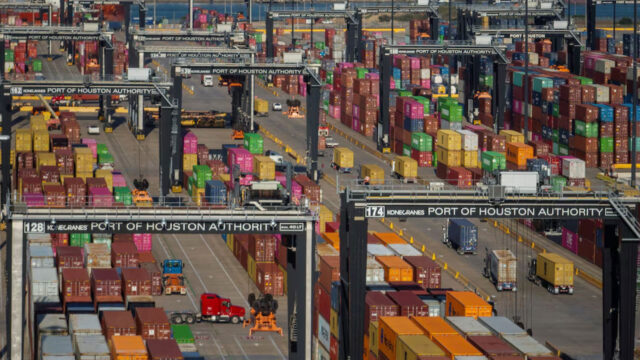

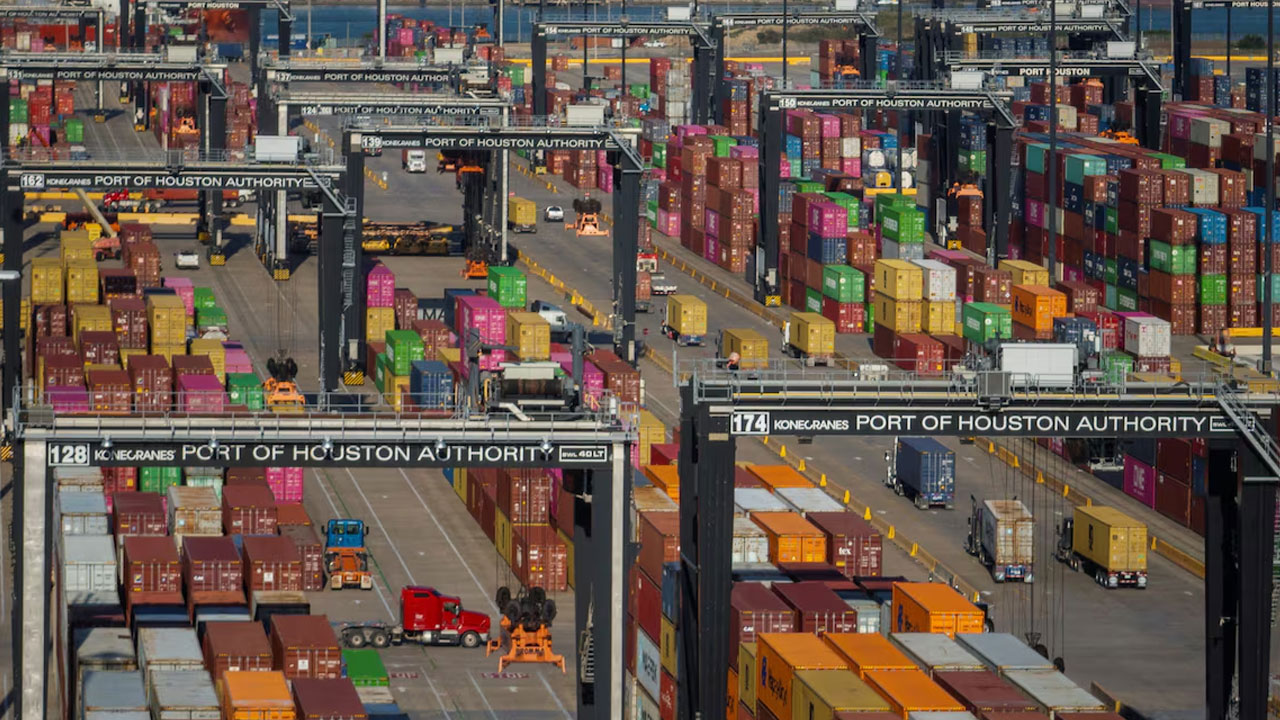

[Source: Reuters]

President Donald Trump’s “reciprocal” tariffs on dozens of countries took effect on Wednesday, including massive 104% duties on Chinese goods, deepening his global trade war even as he prepared for negotiations with some nations.

Trump’s punishing tariffs have shaken a global trading order that has persisted for decades, raised fears of recession and sent stocks around the world reeling.

The S&P 500 (.SPX), opens new tab has shed nearly $6 trillion since Trump unveiled the tariffs a week ago, the deepest four-day loss since the benchmark’s creation in the 1950s. The index is now nearing a bear market, defined as 20% below its most recent high.

A sell-off across Asian markets resumed on Wednesday with Japan’s Nikkei (.N225), opens new tab down more than 3%, South Korea’s currency hitting a 16-year low and government bonds suffering heavy losses as investors dashed for the safety of cash.

U.S. stock futures also pointed to a fifth straight day of losses on Wall Street.

Trump has offered investors mixed signals about whether the tariffs will remain in the long term, describing them as “permanent” but also boasting that they are pressuring other leaders to ask for negotiations.

“We have a lot of countries coming in that want to make deals,” he said at a White House event on Tuesday afternoon. He said at a later event that he expected China to pursue an agreement as well.

Trump’s administration has scheduled talks with South Korea and Japan, two close allies and major trading partners, and Italian Prime Minister Giorgia Meloni is due to visit next week.

The deputy prime minister of Vietnam, the low-cost Asian manufacturing hub hit with some of the highest duties globally, is set to talk with Trump’s Treasury Secretary Scott Bessent later on Wednesday.

The prospect of deals with other countries had pushed stock markets up earlier on Tuesday, but U.S. stocks had ceded their gains by the end of the trading day.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters