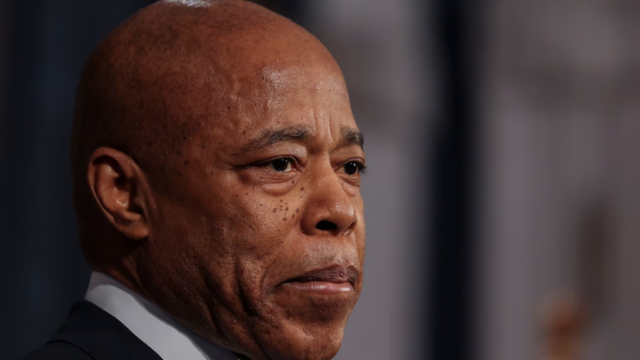

[Source: Reuters]

HSBC (HSBA.L)’s rescue of the British arm of Silicon Valley Bank saved the heavily-exposed UK biotech sector from collapse, but the fallout could hamper funding in a sector the government sees as key to future economic growth, industry executives said.

The move brought an end to frantic weekend talks between the British government, regulators, and prospective buyers, as the survival of many biotech start-ups hung in the balance and U.S. and European authorities sought to stem contagion to the broader financial sector.

About 40% of the UK’s biotech companies, developing drugs for everything from cancer to heart disease, were banking with Silicon Valley Bank’s (SVB) British arm, according to the UK BioIndustry Association (BIA).

Given the time and money required to develop a drug, early-stage biotech firms often operate for years without revenue and depend on start-up-friendly banks like SVB for lines of credit to continue their research and development.

SVB UK has loans of around 5.5 billion pounds ($6.66 billion), deposits of about 6.7 billion pounds and about 3,000 UK clients, according to HSBC.

Around 16 tech and life sciences companies in Europe have disclosed about $190 million in exposure to SVB in the United Kingdom and the United States. UK-based companies, including Diaceutics (DXRX.L), Ourgene Health Plc (YGEN.L) and Windward Ltd (WNWD.L) have said they have exposure to the bank’s UK arm.

Adrian Rawcliffe, CEO of Adaptimmune Therapeutics, a NASDAQ-listed but British-headquartered cancer company, suggested that “for smaller private start-ups, SVB was one of the few banks who really understood the risk profile of early-stage, venture-backed biotech companies”.

Dima Kuzmin, a managing partner of London-based investment firm 4BIO Capital, which does not bank with SVB directly but has portfolio companies exposed to the bank, said many entrepreneurs and CEOs of small start-ups had also opened personal accounts with SVB.

He said following the sector-saving buyout by HSBC, “concern remains over the potential systemic effects”.

Worst case, he said, investors will become more concerned about liquidity in the sector and start drip-feeding the biotechs with smaller funding rounds.

The turmoil follows a difficult year for biotech funding globally. Rising interest rates, recession fears and geopolitical shockwaves saw investors pull back from anything considered risky last year.

In the biotech sector globally, there were only 47 initial public offerings (IPOs) last year that raised about $4 billion in total, compared with 152 offerings in 2021 that had raised over $25 billion.

The SVB collapse also comes after the UK’s biggest listed drugmakers GSK (GSK.L) and AstraZeneca (AZN.L) warned last month that the UK government’s ambition to become a life sciences “superpower” has been hampered by a discouraging tax environment among other problems.

Though the country has renowned scientific research centres at Oxford and Cambridge Universities, it has struggled to convert that into a thriving biotech sector attracting the kinds of funds the United States does, experts say.

Coventry-based biotech company NanoSyrinx had 3 to 4 million pounds worth of funds in the UK arm of SVB, and was scrambling on Friday to extract its money, but was unsuccessful in getting a transfer through, founder and CEO Dr. Joe Healey told Reuters.

Ultimately management was reasonably confident that a resolution was going to be found given the government’s science superpower agenda meant an intervention was likely, he said.

Going forward, there will likely be more second-guessing in the short term for biotech investment in the UK, he added.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters