[Source: Reuters]

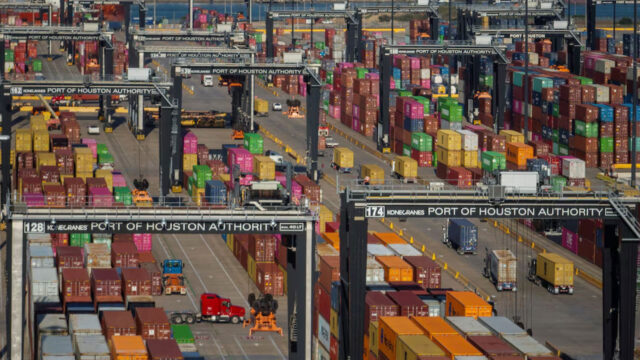

Beijing increased its tariffs on U.S. imports to 125% on Friday, hitting back against President Donald Trump’s decision to raise duties on Chinese goods and upping the stakes in a trade war that threatens to upend global supply chains.

U.S. stocks ended higher, capping a volatile week, as China’s retaliation intensified global economic turmoil unleashed by Trump’s tariffs. But the safe haven of gold hit a record high during the session, and benchmark U.S. 10-year bond yields posted their biggest weekly increase since 2001 alongside a slump in the dollar, signaling a lack of confidence in America Inc.

One U.S. survey of consumers showed inflation fears have mounted to their highest since 1981.

Foreign leaders have puzzled over how to respond to the biggest disruption to the world trade order in decades. Trump’s administration has held firm, touting discussions on a number of trade deals it says will justify its dramatic upheaval in policy.

The tit-for-tat tariff increases by the U.S. and China stand to make goods trade between the world’s two largest economies impossible, analysts say. That commerce was worth more than $650 billion in 2024.

The dollar slid and a sell-off intensified in U.S. government bonds, the world’s biggest bond market. Gold, a safe haven for investors in times of crisis, scaled a record high.

With the dollar weakening, selling of U.S. assets was perhaps most exemplified by the drop in prices of the U.S. 10-year Treasury note.

The decline drove its yield – which moves opposite to the price and is critical for determining interest rates on mortgages – up to a two-month high. On the week, its yield has climbed nearly half a percentage point.

U.S. Treasury Secretary Scott Bessent is closely monitoring the bond market, Leavitt said.

A second day of data on U.S. inflation showed price pressures were not yet building broadly across the U.S. economy, although the Producer Price Index for March did show industrial metals prices rising due to import levies on things like steel and aluminum, in place for a month now.

The University of Michigan said its Consumer Sentiment Index dropped to 50.8 this month from 57.0 in March. Economists polled by Reuters had forecast the index falling to 54.5.

In a reversal of previous surveys, the latest one also showed weakening confidence among Trump’s fellow Republicans.

Consumers’ 12-month inflation expectations soared to 6.7% this month, the highest reading since 1981, from 5.0% in March, according to the survey.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters