It is imperative for the government to do tax reforms, streamline and reevaluate some tax exemptions and incentives, and encourage self-regulation to improve tax compliance.

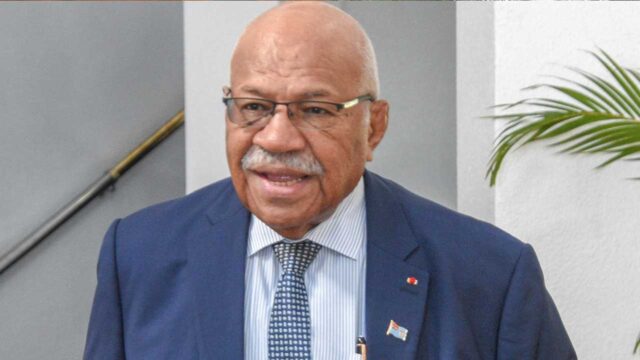

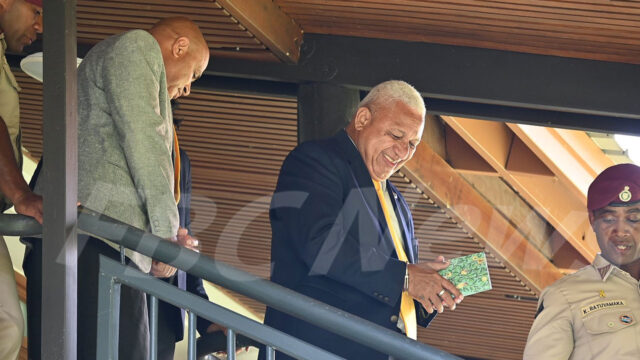

While contributing to the debate on the Fiji Revenue and Customs Service Annual Report for 2017/2018 financial year, Finance Minister Professor Biman Prasad says they intend to widen the tax base by gradually removing tax exemptions.

Prasad says they also intend to make the tax regime even simpler to encourage tax compliance.

“One of the principles of a good tax system is administrative simplicity. If you don’t adhere to that principle of taxation, then you can see a lot of leakage, distortions, and wastage, as well as inefficiencies, in the economy.”

Prasad says in the 2017 and 2018 financial year FRCS collected total revenue of $2.83 billion.

He adds that this is a 9.8% growth compared to the previous twelve months; however, Prasad says it was 8.6% below the forecasted revenue.

The Finance Minister has also assured that additional funding will be provided to Fiji Revenue and Customs Services to fund a fit-for-purpose FRCS that can effectively collect taxes and provide services.

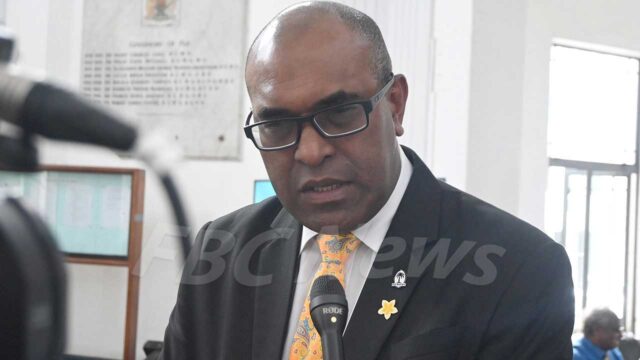

Meanwhile, Opposition Member of Parliament Premila Kumar, while contributing to the debate, welcomed the decision of the Finance Minister to halt the implementation of Stage 3 of the VAT Monitoring System.

Kumar says phase three was for small businesses, and the cautionary approach by Prasad is welcomed.

Kreetika Kumar

Kreetika Kumar