The Fiji Revenue and Customs Service is implementing programs to substantiate the cost of tax evasion in Fiji.

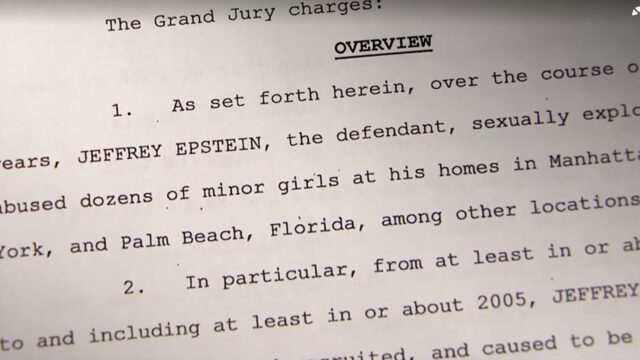

In 2017, six companies were investigated for alleged tax and customs duty evasion totaling over $15 million.

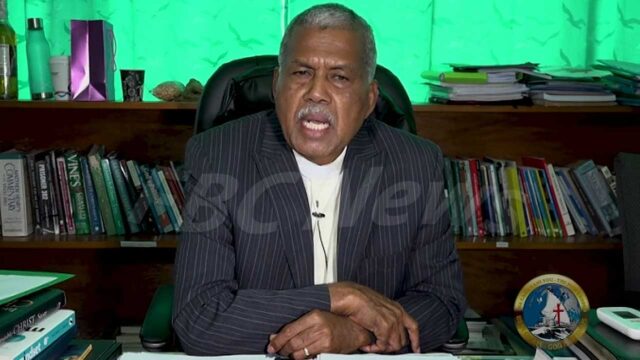

Manager Risk Assessment and Financial Intelligence, Corporate Services, Rohitesh Dass says VAT Gap Analysis Exercise aims to identify the threats posed by tax evasion and its implications on Fiji’s economy.

“We’ve started a VAT Gap Analysis Exercise, so once we’ve completed that exercise, we’ll know in the economy how much the VAT gap is. So VAT is driven from the GDP, so it’s a direct correlation, so once we get that, we will know what amount of taxes are actually evaded.”

Dass says their data-driven strategy will be vital.

“Actually, it’s very hard to calculate the amount of tax that is evaded, but with our systems getting online and a data-driven strategy, we can calculate all this in the future.”

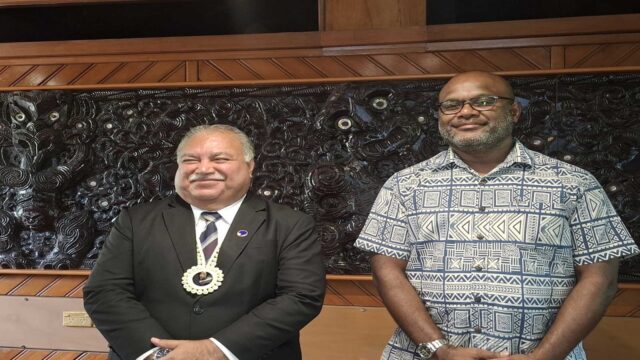

FRCS CEO Mark Dixon says the organization is devoted to curbing tax evasion.

“Every tax administration in the world has some tax evasion happening; our job, I guess, is to make it as small as possible but also to recognize that the vast majority of our tax-paying population want to do the right thing.”

FRCS collected a total of $1.8 billion in tax revenue last year through corporate income tax, personal income tax, and VAT.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kirisitiana Uluwai

Kirisitiana Uluwai