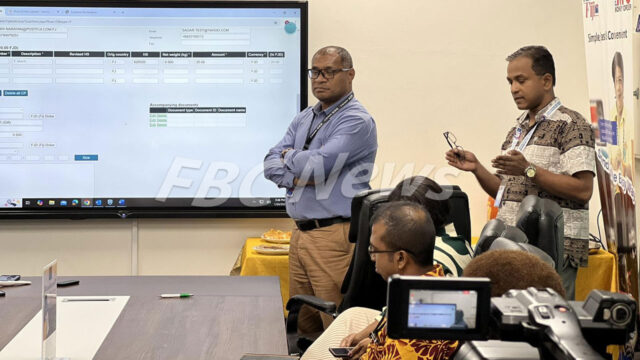

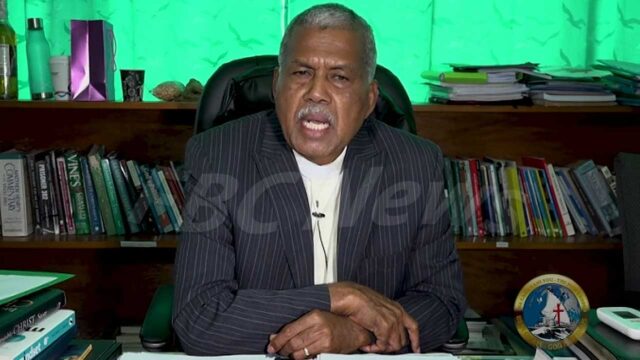

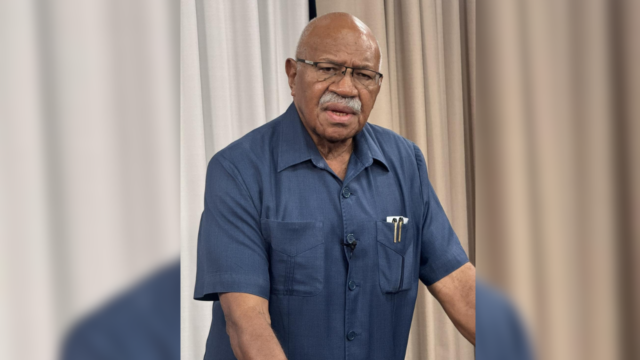

Finance Minister and Deputy Prime Minister Biman Prasad says the secured transaction reform and personal property securities registry is important in mitigating lending risks, especially for micro, small, and medium enterprises.

Prasad highlighted the significant progress in the Secured Transaction Reform and the Personal Property Securities Registry, which is managed by the Reserve Bank of Fiji in parliament today.

Since its launch, the registry has processed over 120,000 notices from more than 120 clients, including banks, credit institutions, finance companies, and their agents, such as law firms.

“The PPSR is the cornerstone of the secure transaction reform, providing an efficient, transparent mechanism for establishing property rights over personal property by lenders and other conditions. So, with the amendment to the Personal Property Securities Regulation 2019, the RBF will continue to offer fee-free services to its clients, and the public search function remains available free of charge 24-7.”

Prasad is also stressing on the need for continued awareness and outreach.

“There is an active campaign, there are workshops, and as I said, a lot of these institutions are actually finding it very useful, and people themselves are also finding it useful, and that’s the reason why the Reserve Bank is keeping it fee-free. We want more people to use that and more and more MSMEs, Mr. Speaker, are using movable assets as security.”

The Finance Minister says the registry, is an online notice board of security interest, enabling lenders and the creditors, to register notices at any time and any place.

He says this allows anyone, to conduct public searches on property rights over collateral.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash