The Asian Development Bank and the Pacific Private Sector Development Initiative are working with banks and credit institutions to develop new and modified lending products aimed at improving access to finance for Micro, Small and Medium Enterprises.

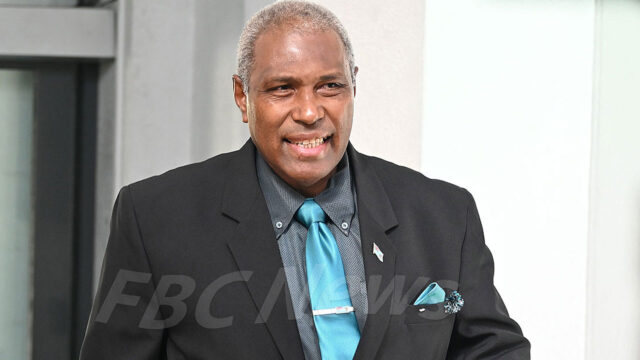

Deputy Prime Minister and Finance Minister Professor Biman Prasad says that this initiative is based on a 2023 baseline survey that identified 1,200 randomly selected MSMEs as potential candidates for movable financing.

The objective, he says is to evaluate the impact of these financial reforms on MSMEs.

To support this effort, Prof Prasad states that the Reserve Bank of Fiji continues to maintain the Personal Property Securities Registry, a vital tool in the Secured Transaction Reform.

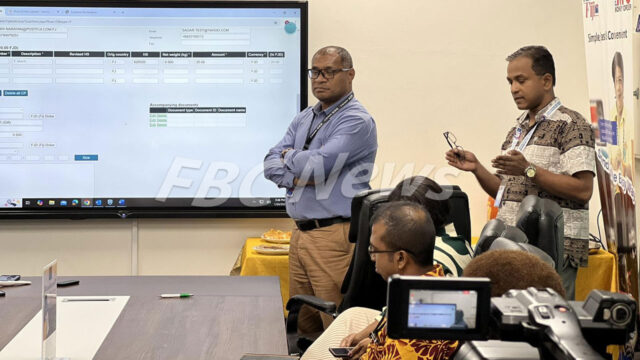

The PPSR serves as an online notice board where lenders and creditors, known as secured parties can register notices of security interests.

This system allows public searches on property rights over collateral, facilitating transparency and protecting both lenders and buyers in private transactions.

As of April 2024, the PPSR has recorded over 124,000 filings from a diverse range of 119 client accounts including commercial banks, credit institutions, law firms, credit unions, finance companies, hire purchase firms and motor vehicle dealerships.

The majority of these filings have been initiated by commercial banks and credit institutions including the Fiji Development Bank.

Prof Prasad says that the PPSR has remained a fee-free service, with the RBF extending this arrangement until May 2026 to encourage continued use and support for MSMEs.

To further promote these new financial products, the RBF, in conjunction with the ADB and PSDI has conducted 18 finance promotion workshops across Fiji this year.

These workshops, according to Prof Prasad aim to encourage banks, credit institutions and finance companies to adopt the newly developed lending products tailored to MSMEs.

Of the 1,200 MSMEs targeted in the 2023 survey, 500 have already agreed to share their data with lenders, opening doors to potential financing.

The RBF remains committed to increasing participation among the remaining MSMEs.

Prof Prasad adds that the PPSR which has been crucial in establishing transparent property rights over personal property will continue to offer its services without charge.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava