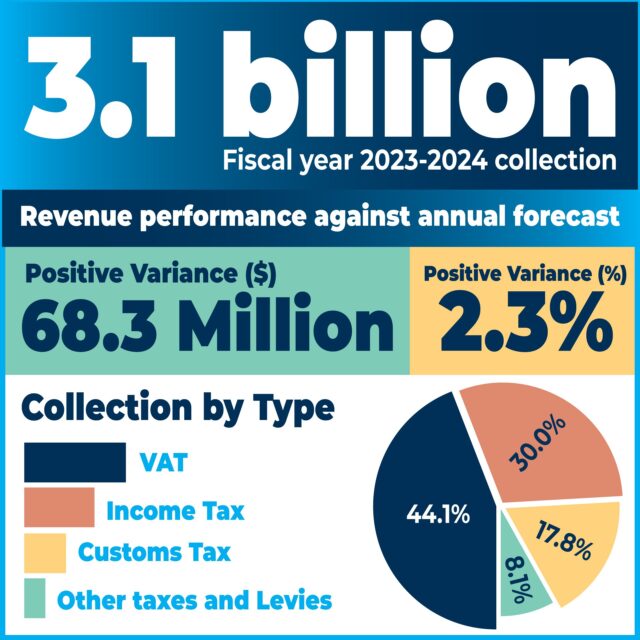

The Fiji Revenue and Customs Service has surpassed $3 billion in revenue collections for the fiscal year, 2023-24.

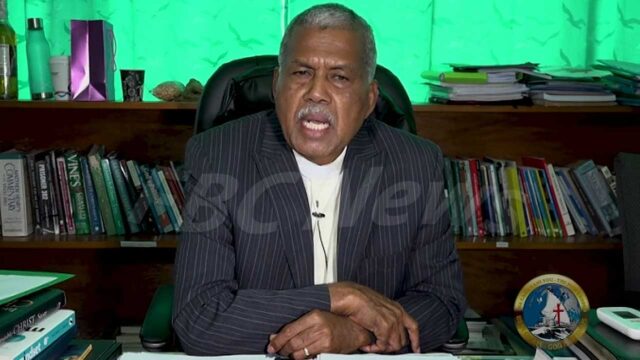

FRCS Chief Executive Udit Singh says with a final net revenue of $3.1 billion, they have exceeded the forecast by $68 million, representing a

2.3% increase.

Singh adds this marks a remarkable growth of $819 million, or 36%, compared to the previous fiscal year of 2022-23.

According to Singh this is the first time FRCS has reached the $3 billion mark.

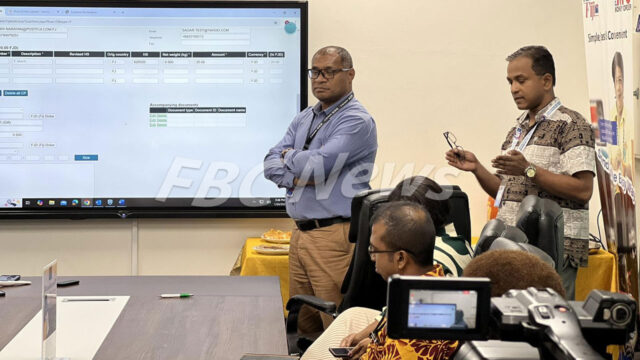

FRCS Chief Executive Udit Singh [Photo: Supplied]

Prior to this achievement, Singh states the highest revenue collections were $2.83 billion in the 2017-2018 fiscal year and $2.81 billion in the 2018-2019 fiscal year, the two years before the pandemic.

Singh highlights the most significant revenue growth has come from Value Added Tax, which now contributes 44% to the total revenue.

He adds the increase in VAT collections can be attributed to the growth in the economic activity and the key sectors, higher import volumes, the change in rate from 9% to 15%, and the compliance initiatives by FRCS.

Singh says income taxes including the Corporate Tax and Pay As You Earn and trade taxes such as fiscal duty and domestic excise taxes, all contributed significantly towards the total collection.

Singh stresses that surpassing the $3 billion revenue mark is a significant achievement for the FRCS and a testament to the resilience and growth of key economic sectors in Fiji.

[Supplied]

He states that their strong performance is a reflection of the robust recovery and expansion in sectors such as manufacturing, wholesale & retail trade, and accommodation & food services.

Singh says their ongoing commitment to tightening compliance measures and supporting taxpayers has been instrumental in achieving this milestone.

He adds that the FRCS has engaged platforms such as the VAT Monitoring System and other profiling tools to proactively identify non-compliance and address them.

He stresses that they remain dedicated to fostering a transparent and efficient tax system that supports Fiji’s economic growth and development.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap