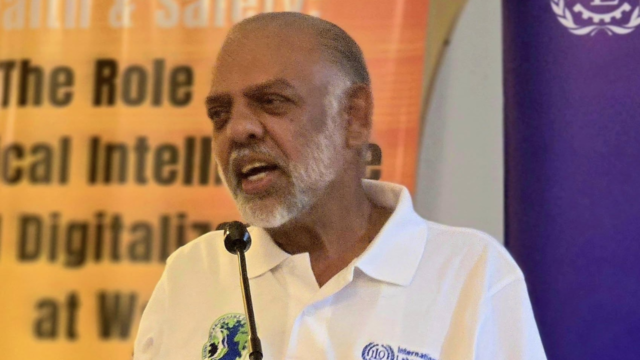

[File Photo]

The Reserve Bank of Fiji has been advised to closely monitor global trade developments, especially the ongoing tariff tensions between major economies.

At a seminar hosted by the RBF, ANZ Foreign Exchange Analyst Felix Ryan warned that uncertainty around tariffs, particularly between the U.S. and China, could lead to long-term disruptions to global trade and economic growth.

Ryan said the 90-day pause on U.S. tariffs offers a window for negotiation, but the situation remains unpredictable.

“Again, some of these expectations are quite dependent on these tariffs changing day to day as well. So it really remains to be seen what the impact is on the hard data. What matters, I think, is if the policy stays consistent for a period of time, then we would see an impact on the hard data, or at least a more probable impact on the hard data”

Ryan noted that there could be another extension or even new rounds of tariffs, and countries like Fiji need to prepare for different outcomes.

This includes assessing how future trade wars might impact their economic ties and identifying new trade partners to reduce risk.

He explained the importance of trade diversification, saying that smaller Pacific economies should not rely too heavily on just a few large markets.

Ryan added that the ongoing uncertainty around tariffs makes it hard to predict outcomes, and governments must remain alert to sudden policy changes.

Ryan also raised concerns about the global economic outlook.

He said expectations around growth have weakened recently, and while hard data such as labour market trends and consumer spending remain relatively stable, long-term tariff actions could change this quickly.

He explained that global market sentiment has become more volatile, which is affecting investment confidence.

During periods of uncertainty, financial markets, especially equities, become more unstable, and this usually reflects lower business and investor confidence.

In China, Ryan said the ongoing slump in the property market and uncertainty about government stimulus measures are contributing to regional instability.

He said China’s future economic performance will largely depend on the level of domestic support provided by the government, especially during its tariff dispute with the US.

To monitor global growth, Ryan pointed to the Global Lead Index, which tracks international manufacturing activity.

He said a drop in this index often signals slowing growth worldwide. This, he added, should serve as a key reference for countries like Fiji to anticipate shifts in global economic momentum and plan accordingly.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava