The Reserve Bank of Fiji can save on printing and handling cash costs after successfully integrating mobile money wallets with bank accounts.

This integration, achieved by onboarding Fiji’s Mobile Network Operators into FIJICLEAR – the backbone of the National Payment System – enables customers to instantly transfer funds between their mobile wallets and bank accounts, as well as make direct transfers between M-PAiSA and MyCash users.

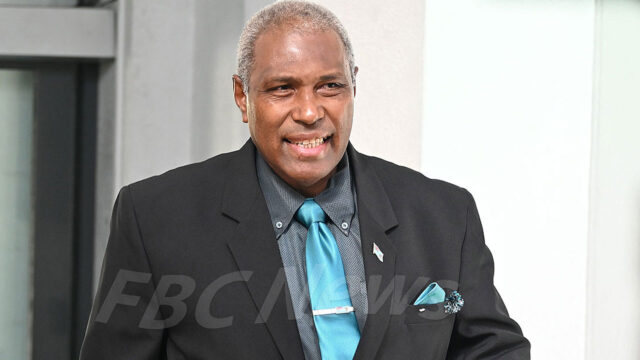

RBF Governor Ariff Ali says they spend millions of dollar every year to print and manage cash.

“For the RBF the cost of printing cash is around $4m annually. The cost of managing this cash that includes our staff, and security – if you add up will be much more. The cost of cash that banks handle in my view combined will be more than $10m including the security, staff and the ATMs and so forth.”

ANZ Fiji Country Head Rabih Yazbek states that every transaction between a mobile wallet and a bank account reduces cash transactions in the economy, significantly impacting overall financial dynamics.

“In a busy year we do 30, 000 plus hours of overtime counting cash, which is not a good use of anyone’s time. It is pretty boring if you ask me. So I am hopeful that with the GO LIVE we start to take big steps forward in moving away from cash.”

The RBF notes that with the rapid rise of digital financial services, consumers are increasingly seeking faster and more convenient payment options.

By integrating the two major mobile wallet providers with the banking sector, the RBF is enhancing efficiency and convenience, empowering businesses of all sizes, and providing access to financial services for thousands of people who lack traditional bank accounts.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

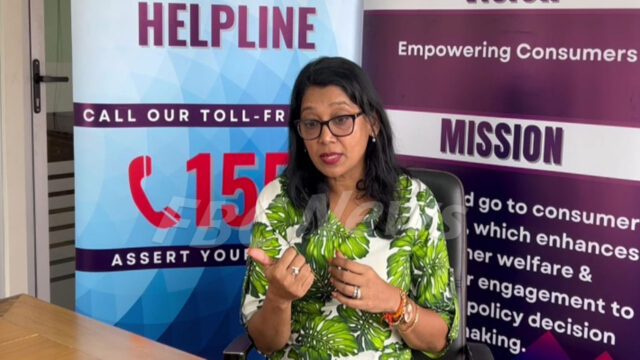

Ritika Pratap

Ritika Pratap