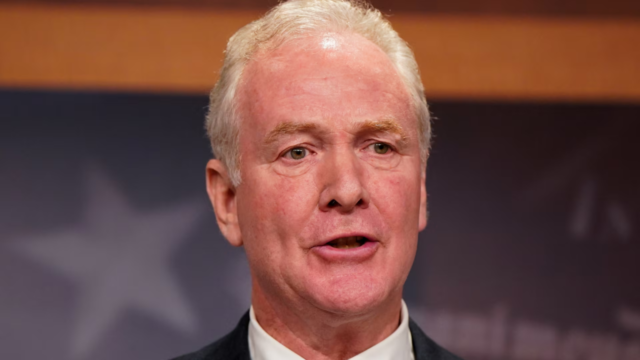

Prime Minister Sitiveni Rabuka has defended the government’s decision to raise the value-added tax from nine percent to 15 percent.

Speaking on Radio Fiji One’s “Na Noda Paraiminisita” program, Rabuka acknowledged concerns about the potential burden this VAT increase might place on Fijians, leading to widespread dissatisfaction.

While recognizing the expense for many, Rabuka has urged Fijians to also consider the benefits resulting from the higher VAT.

“And so this is the explanation behind the tax collection done by the government. We all use the roads and other infrastructure, but what we need to note is that we use the taxes to fund social welfare assistance like pensions and other welfare assistance. This assistance is mostly received by those who are underpaid.”

Rabuka says the increased revenue from the tax adjustment will enable the government to offer greater assistance to citizens.

This aid, he states, encompasses various sectors, including public transportation subsidies, free education programs, and exemption from medicine-related expenses.

Addressing the distribution of the tax burden, the PM notes that while low-income earners might face a heavier tax load, they stand to gain the most from government assistance initiatives.

These measures aim to mitigate the impact of higher taxes and ensure continued access to essential services.

Rabuka further explained that individuals with higher incomes might not immediately feel the strain of the 15% VAT increase.

However, he pointed out that they are also less likely to rely on government assistance, making them less affected by its absence.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava