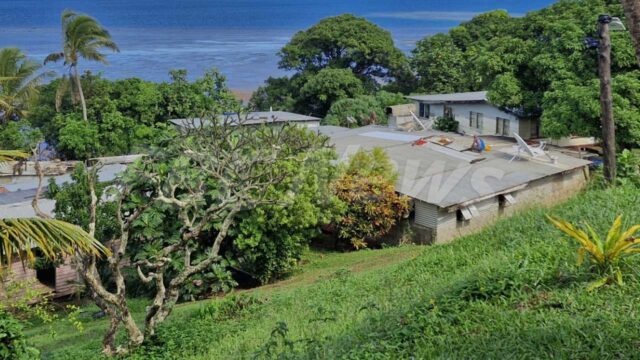

Reserve Bank of Fiji. [File Photo]

The Reserve Bank of Fiji Insurance 2023 report shows progress in lowering unresolved complaints and improving resolution speeds.

The report outlines the ongoing efforts to enhance financial resilience, consumer protection and the sector’s response to climate-related challenges.

Assistant Minister for Foreign Affairs Lenora Qereqeretabua acknowledged the Reserve Bank of Fiji’s expansion of parametric insurance, which uses weather data to trigger payouts for communities affected by natural disasters.

However, she states that the committee has urged further expansion of weather stations to remote areas to improve the effectiveness of these products and ensure timely support for vulnerable communities.

Qereqeretabua also noted the committee recommends partnership between the Ministry for Public Works, Transport, and Meteorological Services and stakeholders to install automatic weather stations in underserved areas.

This data will enhance parametric insurance’s impact, particularly for low-income households vulnerable to climate change.

She also pointed out the committee’s call for future reports to include gender-desegregated data, including the gender ratio of those employed in the insurance sector and the beneficiaries of insurance products, to promote greater diversity and inclusivity.

Trade Minister and Deputy Prime Minister, Manoa Kamikamica spoke about the continued growth of Fiji’s insurance sector, with premiums reaching a record $440.7 million in 2023.

Despite challenges, including rising reinsurance costs and increased claims, Kamikamica stated that the industry has remained stable, with all insurers reporting profits.

He also pointed to the RBF’s role in addressing emerging risks such as cyber threats, which are increasingly relevant for small and medium-sized businesses.

Opposition MP Praveen Kumar raised concerns over the issue of premature policy surrenders, which result in millions of dollars being lost each year.

He called for stronger consumer protection laws and increased transparency from insurance agents to ensure that customers fully understand the terms of their policies.

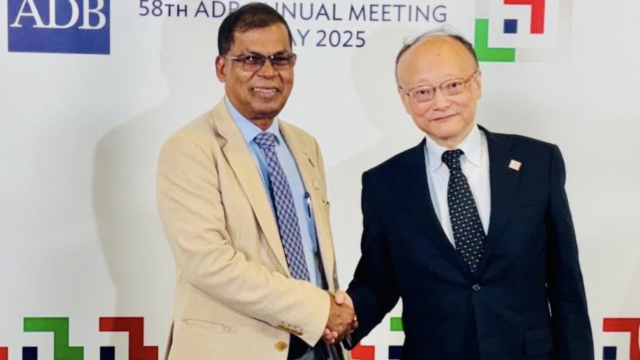

Finance Minister and Deputy Prime Minister Professor Biman Prasad attributed the sector’s growth to Fiji’s economic recovery and forecasted a positive outlook for 2025.

He stressed the importance of continued efforts to strengthen the insurance industry, which is essential for the country’s economic stability.

The exchange several recommendations, including enhanced weather station coverage, expanded micro-insurance options and better data on gender in insurance reports.

These initiatives aim to make the sector more inclusive, transparent and responsive to the needs of vulnerable communities in Fiji.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava