The scale-up of the parametric micro insurance initiative in Fiji is aiming to reach 5,000 policyholders by the end of next year.

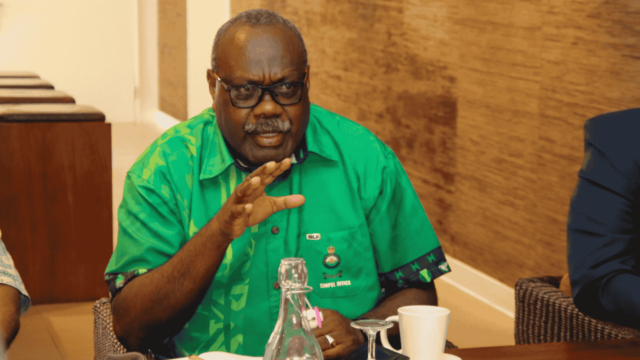

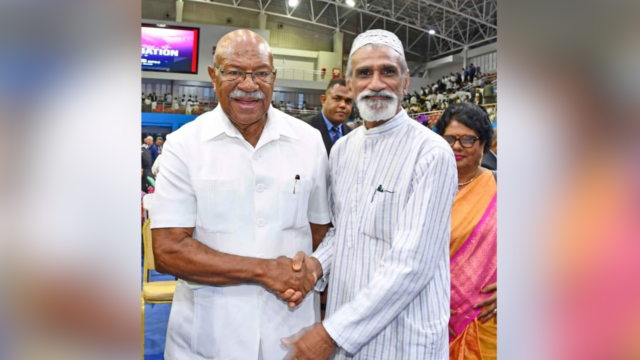

Reserve Bank Governor, Ariff Ali, says the initiative is expecting a total of 25,000 beneficiaries, 45 percent of whom are among a poor and vulnerable population.

Ali states the micro insurance will ensure that those in need are empowered and are provided financial protection.

He adds that this will ensure that no one is left behind in the effort to address climate change.

“Keeping this in mind, these parametric insurance products are specifically designed to address the immediate financial needs that arise following naturally induced disasters, easing the economic burden on individuals and on natural resources. Our mission is clear: to build financially resilient communities across Fiji.”

Ali highlights that as part of its new strategic plan, RBF is setting up a dedicated climate change unit in the governor’s office, which aims to support the development of tailored products, enhance local capacities, and build a sustainable insurance market for Fiji over the next two years.

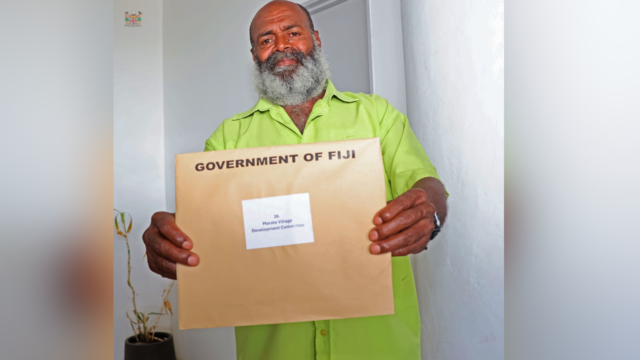

United Nations Development Program Resident Representative Munktuya Altangerel believes this event will showcase the success of these three years since the program began.

“And it will really show how it’s benefitted the farmers, smallholder farmers, fishermen, market vendors, informal sector workers, and other community members, and I was told that already over 35,000 households in Fiji alone benefitted from this very transformative initiative indeed.”

The initiative demonstrates that these pre-arranged financing mechanisms can address and hopefully minimize or avert losses and damages that could happen in individual households and communities.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sivaniolo Lumelume

Sivaniolo Lumelume