The Government will allow Fiji National Provident Fund to invest offshore to optimize the investment portfolio.

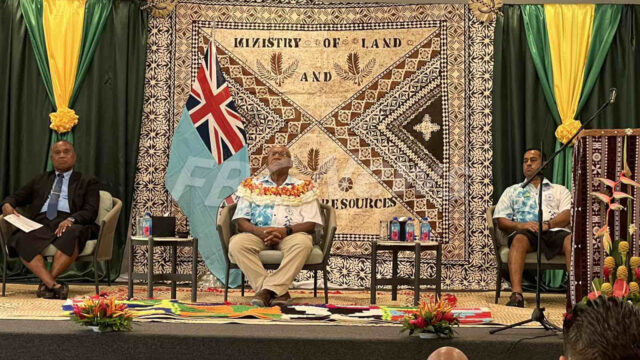

This has been highlighted by Deputy Prime Minister Manoa Kamikamica while speaking in parliament yesterday.

Kamikamica says it is important that the Fund invest offshore to diversify its risks.

He adds that the return on the offshore investment managed funds is a lot higher than what can be achieved locally.

“We will allow FNPF to invest offshore. That is one way of taking funds out of the country and putting them offshore. So that not even our government but when the next government comes in will not have the ability to just go and take the funds of our members and use them wherever they want to.”

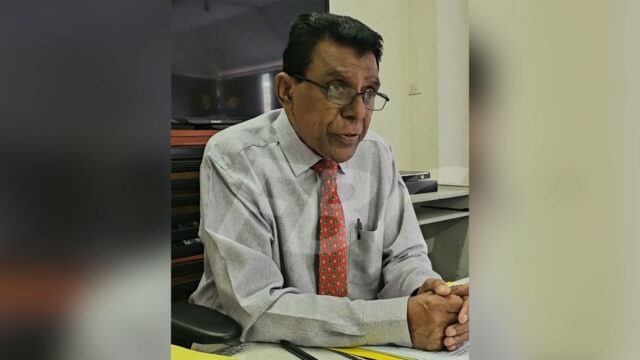

Finance Minister Professor Biman Prasad says through offshore investment FNPF will be able to move away from just relaying on the government bond subscriptions and its returns.

“The Interest rates received from government bonds when compared to what’s available in the market right now could be much higher. So the government will have to look at whether we can continue with the same interest rate.”

Prasad says that the Fund’s investment portfolio was valued at $8.6b in 2022 and the return on new investment was 7.4 percent.

He adds that this was a significant increase from 6.1 percent in the previous year.

Kreetika Kumar

Kreetika Kumar