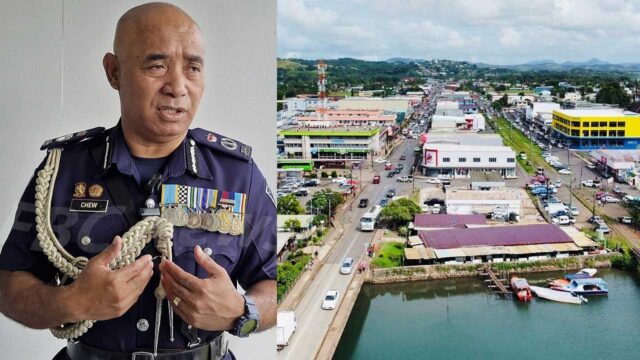

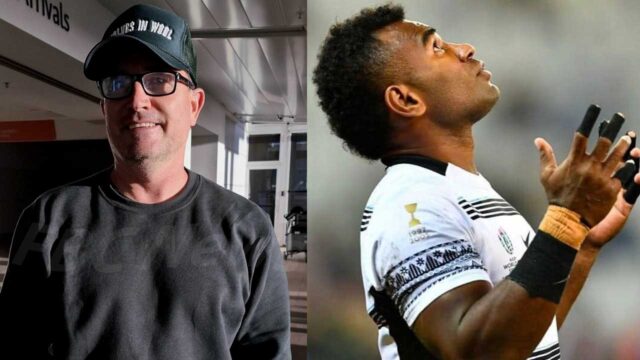

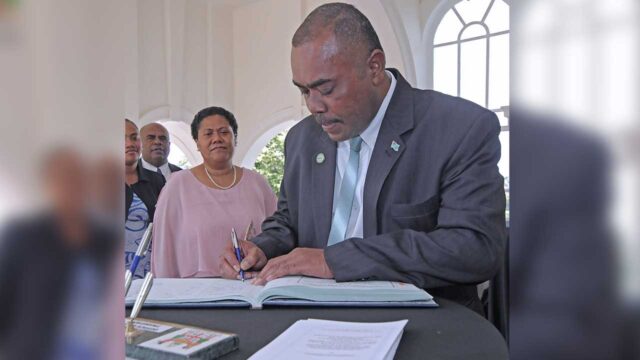

DPM and Minister for Finance, Professor Biman Prasad

The VAT on goods received from overseas is a measure that will bring about equity.

Deputy Prime Minister and Minister for Finance, Professor Biman Prasad says they had instances of misuse, where certain individuals, and retailers, had imported and sold goods without paying VAT.

Professor Prasad says this created an unfair advantage, and people could import every week if they had the money.

Professor Biman Prasad says some people had started running businesses from home which was not fair to those who cannot import online.

“And those who go and buy locally would obviously have to pay the VAT. So it’s a measure that will bring about equity. It’s not going to treat others unfairly. And that’s the rationale for closing that loophole and removing that COVID measure that was there.”

Professor Prasad reiterates that in the 2024/25 budget, the threshold for personal imports under Code 212 has been reduced from $2,000 to $1,000, and a 15% VAT is now levied on that.

He adds that personal importations were treated under Concession Code 212 under the Customs Tariff Act, whereby the importer did not pay fiscal duty, import excise duty, and VAT on all personal imports up to a value of $2,000.

Kreetika Kumar

Kreetika Kumar