[File Photo]

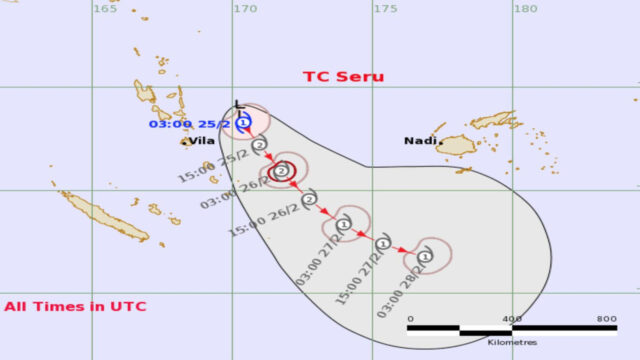

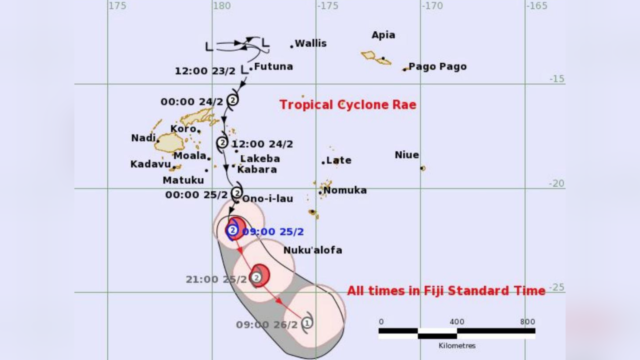

Parametric micro insurance offers immediate financial support to communities affected by natural disasters, bypassing the lengthy damage assessment process required by traditional insurance.

Reserve Bank of Fiji Governor Ariff Ali explained that unlike traditional policies, parametric insurance delivers pre-agreed payouts based on measurable triggers like rainfall or wind speeds.

This approach, he said, allows for faster, more efficient relief following floods, cyclones and other climate-related disasters.

The RBF Governor emphasized the simplicity and speed of parametric micro insurance are crucial in helping communities recover quickly.

“We are equipping Fijians with innovative financial tools that offer protection against the unpredictable force of nature. We are covering our most at-risk communities with a financial safety net that offers timely relief and support, enabling them to recover faster.”

By focusing on measurable triggers, the system ensures those most in need receive financial protection without delays.

Beneficiaries of the policy have shared how the program has transformed their lives, providing timely assistance when disaster strikes.

“You know, not long after the damage of the flood or heavy rainfall, we would get this money, and it does help. You know, with us, it doesn’t work. It takes the bill and puts food on the table. Gets, you know, the going, and it just keeps going.”

“Get down to the grassroots and touch the lives of our lives, the poor and elderly that are present here. And on behalf of them, we will take this opportunity to thank the paramedic insurance for being able to come down to us and touch our lives.”

Ali reaffirmed their commitment to expanding these insurance solutions, aiming to build long-term resilience and empower all Fijians in the face of climate change.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sivaniolo Lumelume

Sivaniolo Lumelume