Access to finance and capital is still a setback for Micro, Small, and Medium Enterprises (MSMEs) owners.

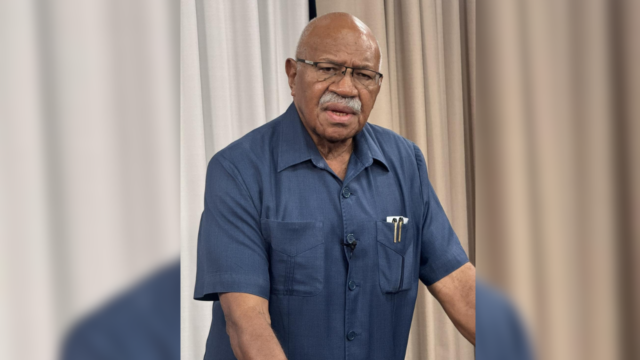

This was highlighted by the Fiji Commerce and Employers Federation Acting Chief Executive Officer, Savenaca Baro, who reiterates the need to establish programs like Fiji Enterprise Engine that will train entrepreneurs in effective business practices.

He reveals that the federation is working closely with the government to ensure that the required services are provided for the expansion of small businesses.

Baro says that investment will play a crucial role in combating these challenges, as the government and financial partners can create a more supportive ecosystem for MSMEs, helping them thrive and contribute to economic growth.

“Access to credit has been a constant issue. So, there is a need to look at investment for MSMEs. The government has put a focus on this by allowing more grants for MSMEs. However, it is also working with other financial partners to explore the possibility of extending and expanding in this area.”

Baro adds that FCEF is exploring ways to enable partnerships with large corporations and organizations like Fiji Development Bank and Capital Insurance, with the aim of providing bigger platforms for MSMEs.

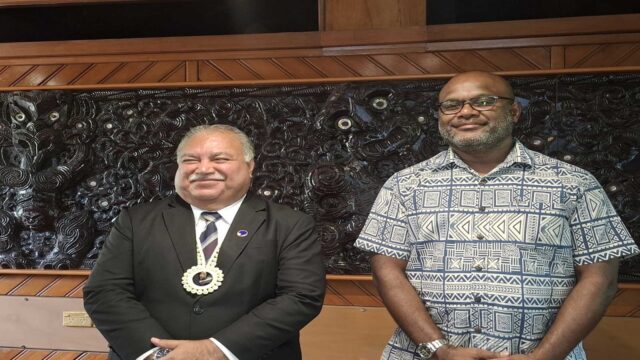

Deputy Prime Minister and Minister for SMEs Manoa Kamikamica says that the government is providing tax incentives and additional support for small businesses that are unable to access essential services.

He adds that supporting MSMEs ensures that more people can participate in the economy, including women, minorities, and other underrepresented groups.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala