Fiji’s housing market is seeing benefits from low interest rates, largely due to the Reserve Bank of Fiji’s monetary policy.

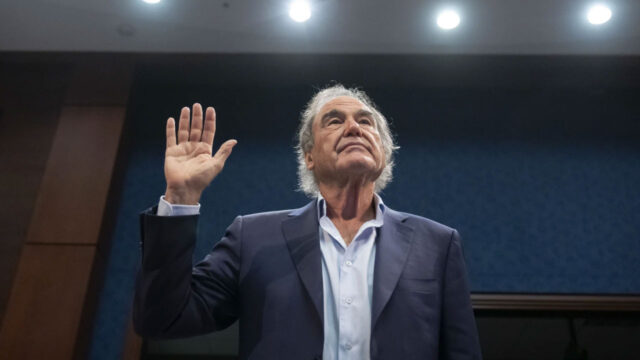

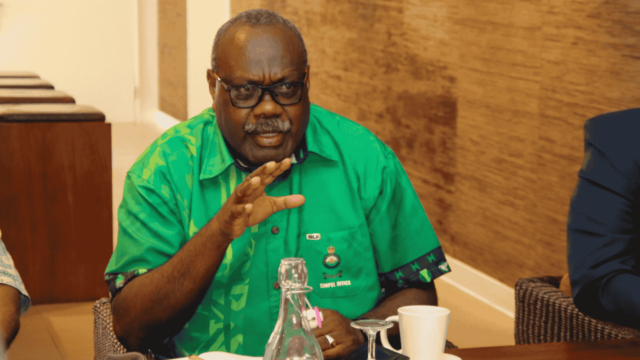

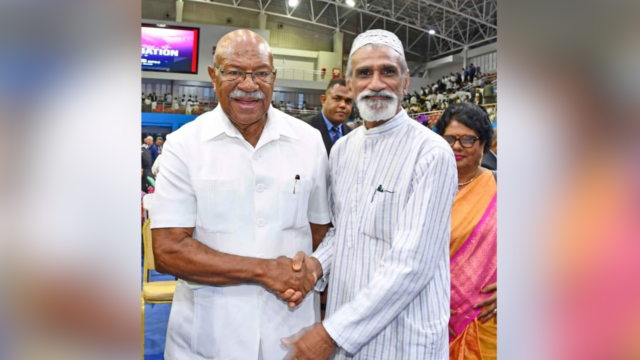

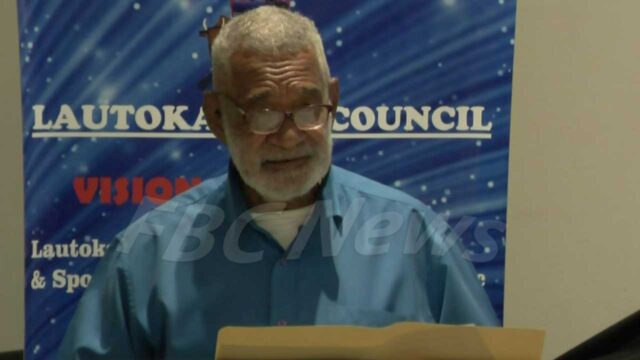

RBF Governor Ariff Ali says that interest rates have dropped substantially over the years.

He said he joined the bank 32 years ago; the average lending interest rate was 13.6 percent, but today, rates stand at just over 4 percent, with some corporate loans as low as 3 percent to 3.5 percent.

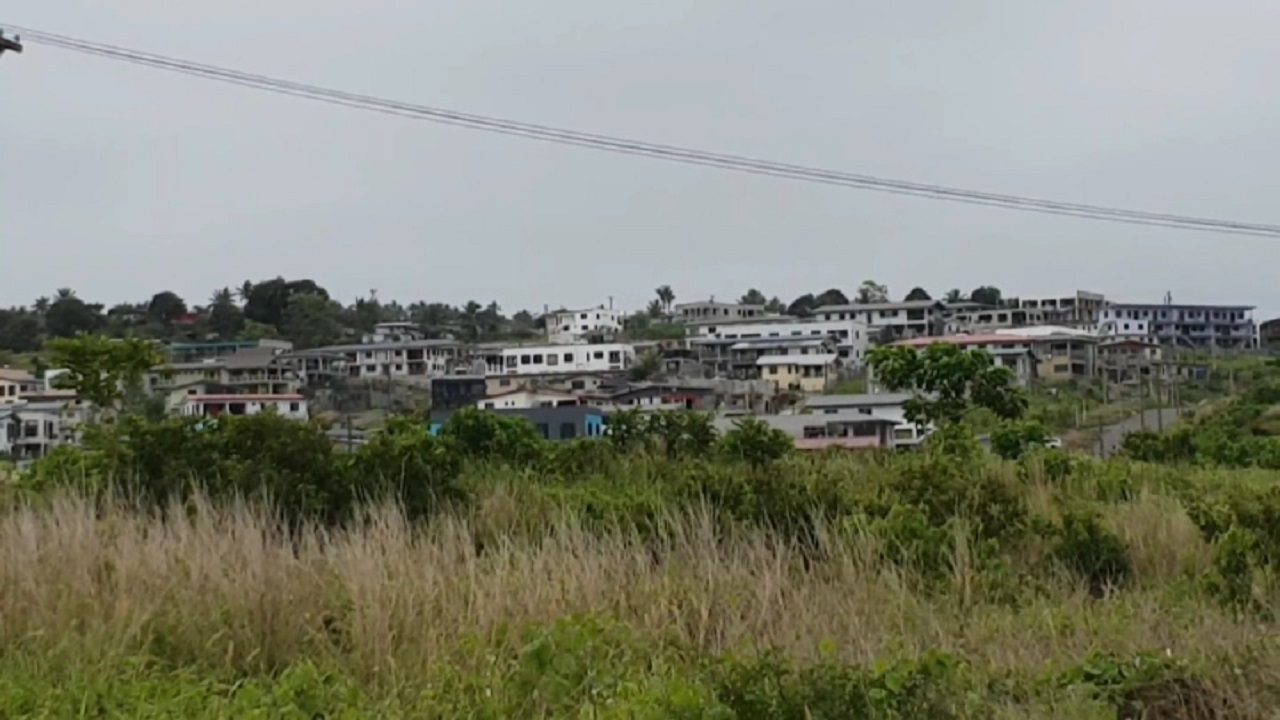

These lower rates, Ali says, have made borrowing more accessible, enabling more Fijians to secure financing for homes.

Low housing interest rates have increased affordability for potential homeowners, a direct outcome of the Reserve Bank’s policy to maintain low rates.

“Interest rates are low; it simply means people can borrow more because the cost of financing is cheaper.”

Ali explained that these reduced rates are crucial for supporting the recovery of Fiji’s economy, particularly in the wake of the COVID-19 pandemic.

With strong foreign reserves, the RBF remains confident in sustaining this policy to encourage ongoing economic growth.

Ali expressed optimism that the low interest rates would not only boost the housing market but also drive construction activity.

This could, he said, encourage more people to build or renovate homes, further contributing to economic growth.

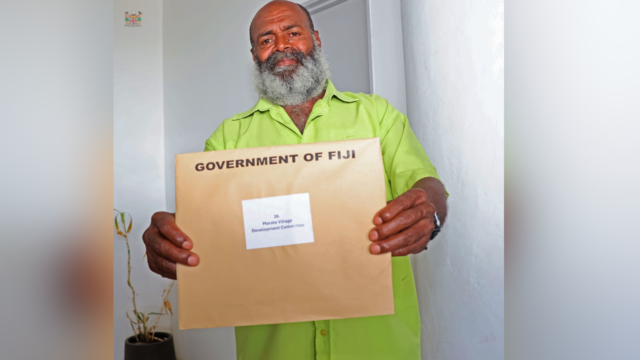

Deputy Prime Minister and Finance Minister Professor Biman Prasad reinforced this view, stating that the Reserve Bank’s accommodative monetary policy has created a favorable borrowing environment.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava