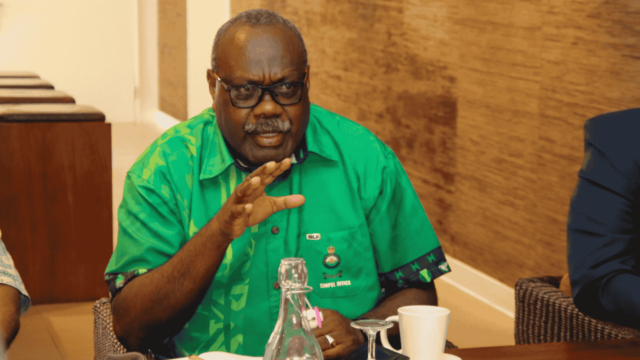

UNDP Policy Analyst Emily Roberts has proposed raising cigarette taxes to 75 percent of the retail price. [File Photo]

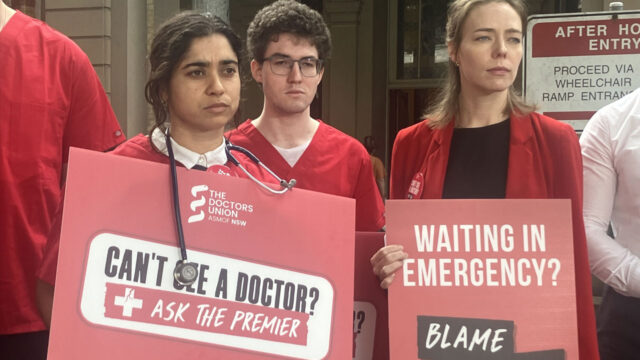

The Health Ministry has proposed an increase in tobacco taxes, aiming to raise up to $53 million in revenue over the next five years.

This move is part of a critical effort to tackle the severe health and economic impact of smoking in Fiji.

The recommendation is part of the Investment Case for Tobacco Control, a report developed in partnership with the World Health Organization and the United Nations Development Programme.

UNDP Policy Analyst Emily Roberts has proposed raising cigarette taxes to 75 percent of the retail price.

“So there’s substantial reduction in economic losses by investing in these tobacco control measures and then compared to the required investment over 15 years it’s only $15.2 million so you can see the benefits substantially outweigh the cost of intervention.”

Roberts stated that the revenue generated could fund vital health coverage and social protection programs while strengthening national tobacco control strategies.

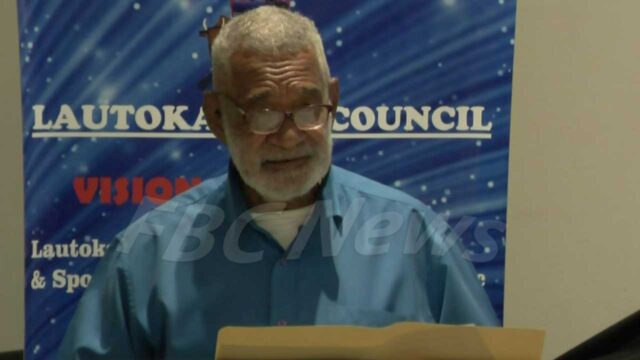

Health Minister Dr Atonio Lalabalavu acknowledged the urgency of this issue, pledging to bring the recommendations to the government for consideration.

“It would be remiss of the government and the Ministry of Health not to take into full account the five considerations. The five considerations are in the report and that is up to the Ministry of Health. We’ll push for those five considerations to be adopted by the government.”

Public health advocates argue that bold steps, such as higher taxes, are essential to curbing tobacco use and saving lives, while also reducing the immense strain on Fiji’s resources.

Tobacco-related illnesses claim 1,200 lives every year in Fiji, burdening the economy with $318 million in annual costs.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad