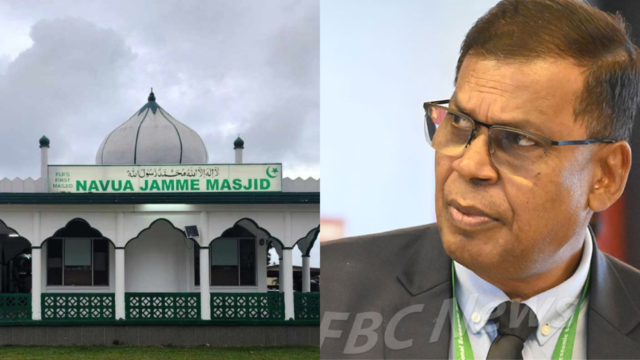

The coalition government is expected to collect over three billion dollars from the revenue-generating activities that are part of the 2023-24 national budget.

This includes $1.4b in Value Added Tax, $816.4million in Direct taxes, $556million in customs taxes, $99.8million in departure tax, $216.8m in grants in Aid, $166,6million in fees, fines, charges and penalties and

$ 207.7 million in other revenue activities.

The other forms of government revenue include $124.6million in dividends from investments and $91.6million from water resources tax

Finance Minister Professor Biman Prasad says the additional revenue that the government is collecting will go towards social welfare, water supply, and road projects.

“So all I want to say to the people is there are a lot of measures in the budget that addresses the cushions the effect of some of these increases, but a lot of the revenue that the government is going to end from increases not just in VAT. Company tax nobody’s talking about that. And the measures that are there. So what people will find eventually, you know, in the next one or two weeks when things settle down as I said there is a lot of misinformation.”

Professor Prasad says the economy is expected to grow by eight percent in 2023, 3.8 percent in 2024 and three percent in 2025.

However, he adds some risks that will affect this growth including geopolitical tensions, loss of skilled workforce and climate change.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainiani Boila

Sainiani Boila