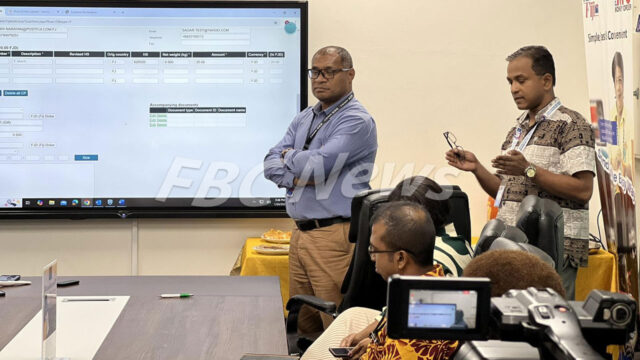

[Source: Supplied]

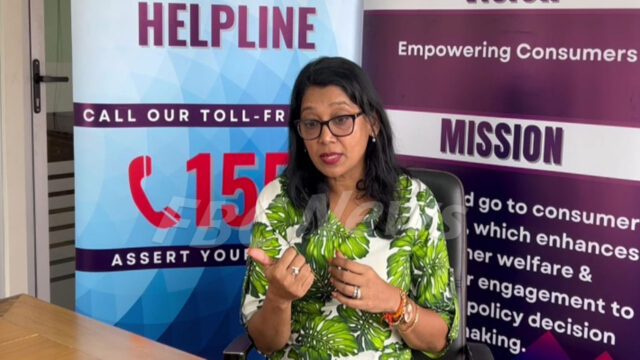

The Fiji Revenue and Customs Service has trained around 3000 representatives from a diverse group of Micro, Small and Medium Enterprises on tax and customs processes.

This financial literacy will assist them with ease of doing business and improve voluntary compliance.

FRCS states 75 percent of those trained have complied and lodged their tax returns.

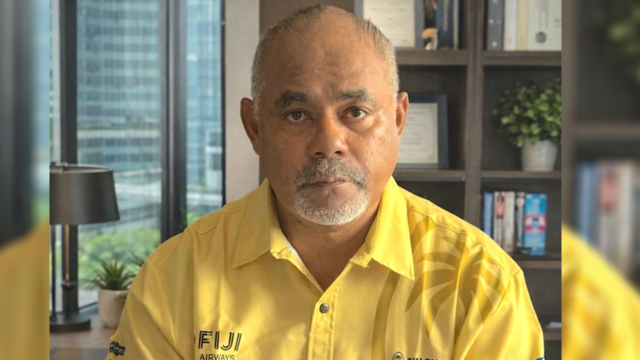

[Source: Supplied]

Chief Executive, Udit Singh says MSMEs play a significant role in Fiji’s economy by contributing towards creating jobs, income generation and poverty alleviation.

Singh stresses that the training was important as they realize the MSMEs lack of understanding of the tax system can contribute to non-compliance.

There are approximately 116,800 MSMEs registered with FRCS, contributing almost $59million in taxes annually.

FRCS has a dedicated Support Centre for MSMEs to assist them with their tax obligations through free advisory services, mentoring, training and support.

Singh says FRCS also plans to introduce training in bookkeeping as it has been seen that another determinant of tax compliance by MSMEs is the absence of financial reports.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap