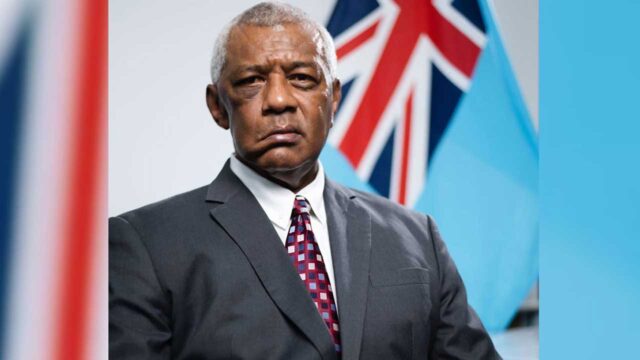

[ Source : Fiji National Provident Fund ]

The Fiji National Provident Fund’s investment portfolio increased from $9.5 billion in 2023 to nearly $10.6 billion in 2024.

The Fund aims to maximize long-term returns while managing short-term fluctuations to balance risk and reward.

Chief Executive Viliame Vodonaivalu says that over the past three years, FNPF has strengthened its strategy to secure the best outcomes for its members.

He adds that their investments are directed toward resilient sectors designed to withstand economic challenges, ensuring long-term stability and growth.

“Our total investment portfolio is made up of fixed income, equity, commercial lending, properties, and cash and term deposits. I will now go through the achievements of our investment portfolio. Under fixed income, government securities closed the year at 4.3 billion.”

Vodonaivalu says that they will continue to pursue opportunities in their growth strategy, which will help maximize collaboration with regulators.

He adds that over the next three years, they have undertaken a major initiative to review their scheme design and determine the optimal operating model for FNPF.

Ninety percent of the organization’s investments are in Fiji, but with limited local options, they also explore attractive growth opportunities overseas for better returns.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala