The Financial Intelligence Unit has implemented risk-based supervision across financial institutions and non-financial businesses including legal practitioners, real estate agents and accountants.

This supervision which commenced last year aimed to ensure that these entities maintained robust internal systems and controls to prevent misuse for money laundering, terrorism financing, and other serious financial crimes.

The Unit disseminated 429 intelligence reports to law enforcement agencies, regulatory bodies, and government ministries.

These reports were largely derived from suspicious transaction alerts submitted by financial institutions across Fiji.

FIU Acting Director Esther Sue states that a key accomplishment was the completion of a comprehensive assessment of money laundering and terrorist financing risks within Fiji’s banking sector.

The findings of this assessment are now available on the FIU website for public access.

Sue says that FIU’s efforts were further supported by off-site monitoring of compliance among financial institutions and non-financial businesses.

Adopting a risk-based supervision approach allowed the FIU to allocate resources effectively to high-risk entities, given the extensive number of institutions under its supervision.

To foster digital innovation in the payment system, the FIU introduced new guidelines on the use of digital ID systems for customer due diligence and electronic Know Your Customer (eKYC) processes.

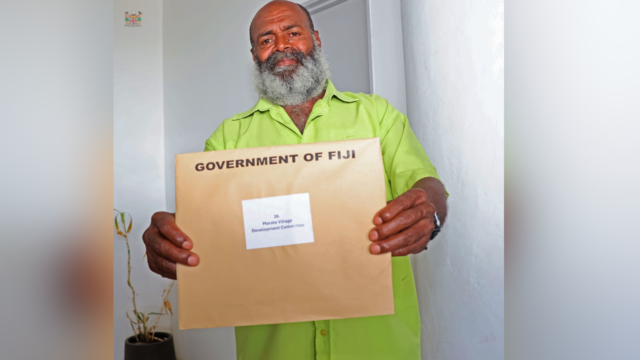

Sue says that the Attorney-General’s presentation of the FIU’s annual report highlights the Unit’s vital role in enhancing Fiji’s financial integrity.

The report details the FIU’s continued efforts and achievements in tackling financial crime and ensuring regulatory compliance.

Sue adds that the A-General tabled the 2023 Annual Report of the Financial Intelligence Unit in Parliament, highlighting a year marked by significant advances in financial crime prevention and oversight.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava