Reserve Bank of Fiji

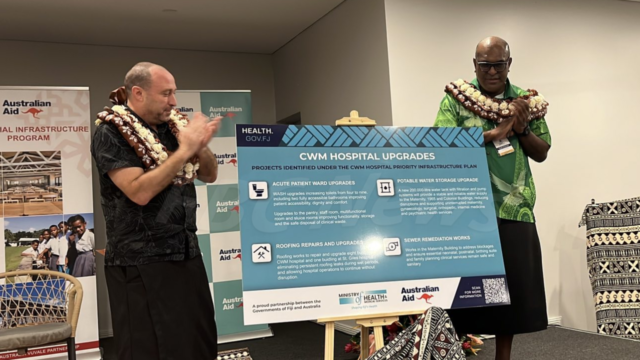

The Financial Services Ombudsman will function as an impartial platform dedicated to resolving disputes between consumers and financial services providers regulated by the Reserve Bank of Fiji.

Deputy Prime Minister and Minister for Finance Biman Prasad says the Financial Services Ombudsman will play a crucial role in maintaining transparency and accountability in Fiji’s financial services sector.

Prasad states that the existing complaints management function undertaken by the RBF will be maintained but elevated to ensure this function is conducted by an appointed Ombudsperson.

“Its primary responsibilities include investigating complaints, facilitating discussion, ensuring fair resolutions. Its role is crucial in providing consumers with a reliable mechanism to address the grievances which ultimately helps to build trust and confidence in the financial services sector.”

Speaking on the Ombudsman’s impartiality since the office will be based within the RBF, Prasad says that the credibility of the Reserve Bank rests on its independence in conducting monetary policies.

However, Prasad adds that they will review the effectiveness of the Financial Services Ombudsman within a year, including the number of complaints received and how effectively they were resolved.

Opposition MP, Jone Usamate questioned the role of the Ombudsman.

“I’m not too sure if his role will be like more of a mediatory role where the parties come to a conclusion or more like an arbiter, but if it is an arbiter, would his decisions then be legally binding on the parties? Oh, her position, sorry.”

In response, Prasad says there is still an option to consider establishing a completely independent office with its own legislative framework.

“The original recommendation that was made in 2000 as part of the banking inquiry suggested a separate, a completely separate office of the Banking Ombudsman at that time. Over the years, the Reserve Bank assumed and there were changes made for it to have a special, you know, complaints management framework, which has been working, but this office itself is going to strengthen and perhaps, you know, provide a lot more teeth for an office within the Reserve Bank.”

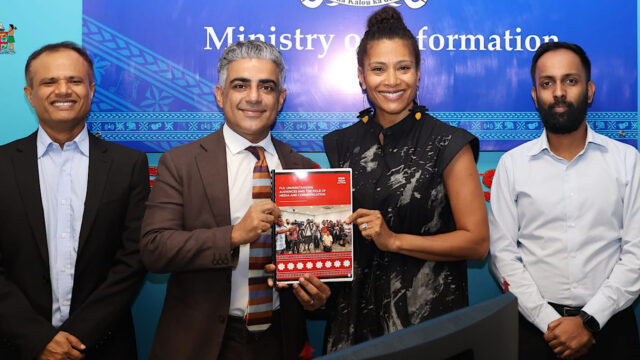

Wati Seeto has been appointed as the first Ombudsperson, as announced by the RBF last month.

Seeto has 25 years of legal expertise, including 15 years in financial regulation and consumer protection.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap