The Fiji Revenue and Customs Service reported a total of $306.6 million in Import Duty, $737.7 million in VAT on Imports and $321.6 million in VAT refunds.

This is from January to October 2024, Fiji’s revenue from Import Duty, VAT on Imports and VAT re-funds saw continued strong performance, underlining the ongoing economic recovery post COVID-19.

This marks an extensive contribution to Fiji’s fiscal performance, reflecting structural adjustments to tax rates and the improving economic landscape.

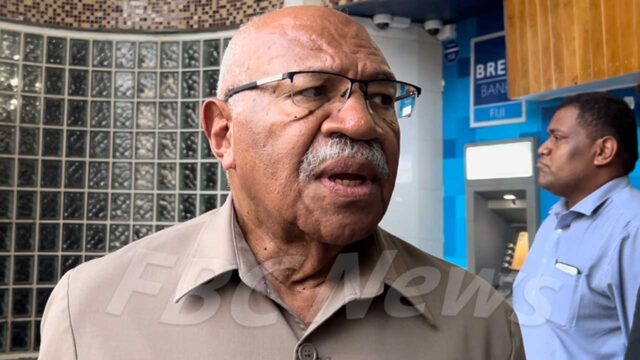

According to Deputy Prime Minister and Minister for Finance Professor Biman Prasad, the figures for 2023 and 2024 show robust recovery from the pandemic with the government’s fiscal and tax policies playing a key role in this growth.

Notably, changes to the VAT system in 2023 which simplified the rates to just two bands zero per cent and 15 per cent have had a major impact.

These adjustments, effective from August 2023 reduced VAT on numerous essential items, including a newly added list of prescribed medicines while maintaining zero-rated VAT for existing essentials.

Prof Prasad said government efforts to adjust import duties have seen key modifications in recent years.

In 2022-2023, import duties on used and new passenger cars were increased while import VAT on electric vehicles was reduced to zero per cent.

Further changes were implemented in FY2023-2024, including a five per cent increase in import excise duty on new and used passenger vehicles.

At the same time, fiscal duty reductions were made on various food products such as canned meats and prawns, as well as on raw materials for certain industries, reflecting the government’s focus on reducing costs for consumers and businesses.

The revenue growth is also linked to a series of duty and VAT rate reforms introduced as part of Fiji’s broader fiscal strategy.

Among these, Prof Prasad pointed out that the most significant was the reduction in fiscal and import excise duties on nearly 2,000 items in FY2020-2021, bringing them to either zero per cent or five per cent.

These adjustments were aimed at making imports more affordable and stimulating demand.

As part of its fiscal reforms, the government also introduced a 15 per cent VAT on personal imports above a new $1,000 threshold in the FY2024-2025 Budget.

This move follows the earlier policy of increasing the threshold to $2,000 during the COVID-19 pandemic, which was designed to support personal imports and facilitate remittances from families abroad.

Also, a five per cent increase in excise duties on alcohol and tobacco was implemented for FY2024-2025, reflecting ongoing efforts to balance fiscal needs with consumer behavior.

Prof Prasad stated that the revenue figures from 2023 and 2024 provide clear evidence of the effectiveness of the government’s policy adjustments.

These policies, he said have not only supported Fiji’s recovery but have also helped to stabilize revenue generation across key sectors of the economy.

Prof Prasad had outlined this in his written response to Parliament.

Litia Cava

Litia Cava