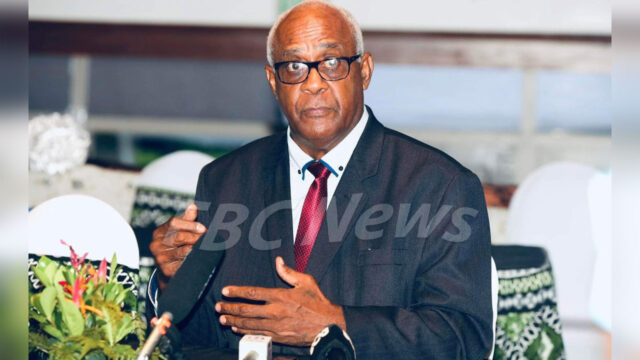

The coalition government’s first-term budget 2023-24 last June was perhaps ambitious on its revenue initiatives says Pacific Economist Kishti Sen.

In ANZ’s latest Pacific Insight, Sen says the increase value-added tax from 9% to 15%, a five percent rise in corporate tax rate to 25% and the re-imposition of the three percent % import duty on raw materials were the most debated topics following that budget’s delivery.

He says the government’s second budget, delivered last Friday, is more measured.

This time, Sen adds the changes to government subsidies, tax concessions, tax rates and superannuation settings are more modest.

The government has assured stability in policy and legislation.

According to Sen any future changes will involve widespread industry consultation to minimise unintended consequences from any sudden changes in the direction of government policy.

He states that this should boost investor confidence.

According to Sen it’s now up to the private sector to take the baton from the government and drive economic activity.

Sen adds operating expenditure is relatively high and may need to be addressed in future budgets to avoid it becoming a problem.

A combination of revenue growth on the back of robust private spending and job creation and expenditure restraint through conservative budgets should keep a lid on interest payments, deliver a smaller deficit and hasten the reduction of the debt-to-GDP ratio.

Sen says the removal of the three present duty on imported raw materials, dropping of the mooted dividend withholding tax and a range of tax concessions and holidays for private sector investment in projects such as Drug Rehabilitation Centres are the signature policy measures of Budget 2024-25.

He says these announcements are likely to be welcomed by the business community.

Sen says income support payments, such as a staged rise in minimum wages from four dollars and hour to five dollars by April 1st 2025, an increase in civil service wages and a rise in pension and social safety net payments flow through to private consumption, boosting consumer spending in the third quarter of this calendar year.

Ritika Pratap

Ritika Pratap