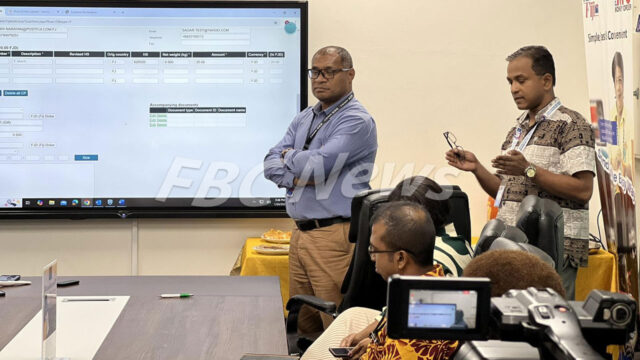

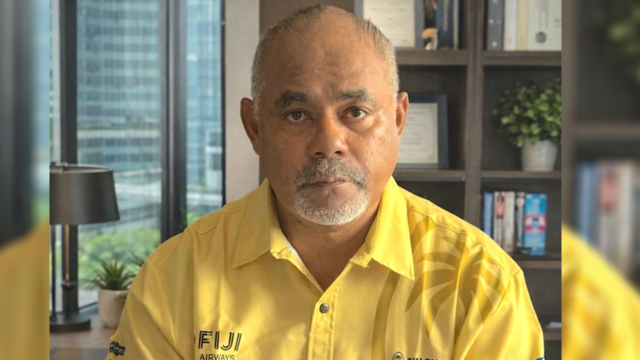

Reserve Bank of Fiji Acting Deputy Governor, Petaia Tuimanu says Fiji’s financial system continues to remain resilient amid the significant level of global economic challenges that could undermine confidence and exacerbate traditional banking risks.

Tuimanu made the comments while releasing RBF’s Financial Stability Review for 2024, which provides the assessment of the state of, and risks to, the financial stability of the Fijian financial system.

Tuimanu says the prevailing low-interest rate environment continues to stimulate credit growth within the economy by helping offset debt servicing costs, incentivizing demand for credit, hence fostering economic activity.

He adds credit over the year increased by 9.3 percent to $11.8 billion as at 30 June 2024 and is expected to grow further with the expected positive economic outlook for 2024.

In this regard, Tuimanu says the monitoring and management of credit risk in the broader financial system will be an important focus area going forward.

Consequently, he highlights that the RBF will continue to closely monitor the performance of banks and other supervised entities and, if warranted, implement measures considered necessary to maintain the safety and soundness of the Fijian financial system.

Moreover, Tuimanu says this year’s edition of the Financial Stability Report also explores the impact of digital transformation on the Fijian financial system.

The Deputy Governor says given the significant changes in the Fijian payment system landscape, the RBF will continue to monitor developments in this space in collaboration with key stakeholders.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap