The government has defended its decision to maintain low interest rates despite suggestions from the International Monetary Fund.

The IMF has recommended raising interest rates as a way to address inflationary pressures.

However, the government believes its current approach is more suitable for Fiji’s economic needs.

This neutral stance, according to the IMF, would involve raising interest rates to combat inflationary pressures.

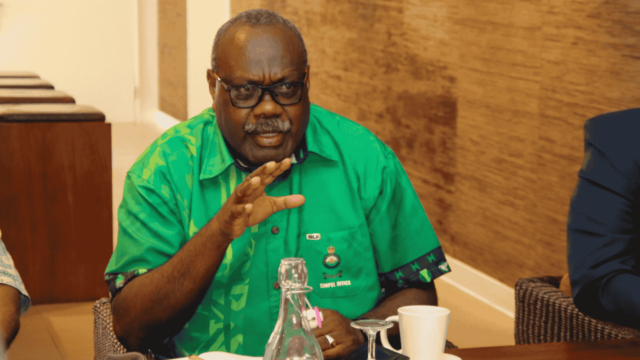

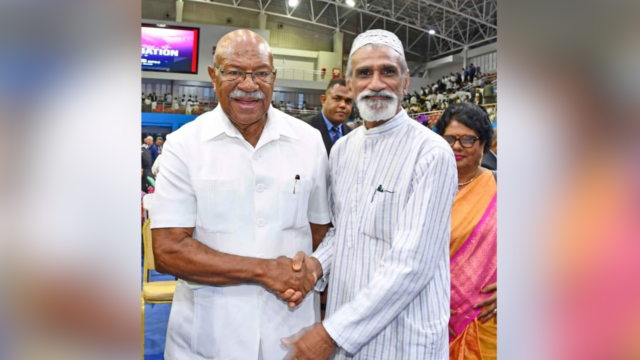

However, Finance Minister and Deputy Prime Minister Professor Biman Prasad said that while the government values the IMF’s advice, Fiji’s unique economic circumstances have guided its approach to monetary policy.

The Reserve Bank, he stated which is responsible for managing monetary policy, has worked closely with the government to keep the overnight policy rate at historically low levels.

“You know, they come here, they tak to us, and they talk to different players. But ultimately, it’s the government, you know, that decides what is right for the country. And we’ve assessed that keeping an accommodative, you know, monetary policy, which means, you know, keeping the overnight policy rate, you know, stable has worked for us and worked for the people.”

This decision, according to Prof. Prasad, has had a positive impact on the economy.

By maintaining low interest rates, he believes that the government ensures that borrowing remains affordable, which in turn supports investment, business activity, and overall liquidity in the financial system.

Prof. Prasad acknowledged that inflationary pressures have been a concern, with some of the inflation in 2023 attributed to adjustments in the country’s VAT rates.

However, he pointed out that a huge portion of inflation is driven by external factors, particularly the cost of imports.

In this context, the government’s strategy of keeping interest rates low is aimed at cushioning the economy against these pressures.

The IMF’s recommendation to raise interest rates is part of a broader effort to bring inflation under control globally.

The IMF has called for a neutral monetary stance, which typically involves higher interest rates.

However, Prof. Prasad noted that increasing interest rates could have negative consequences for businesses and consumers.

He outlined that higher borrowing costs would lead to more expensive loans, including housing and business loans, which would, in turn, raise costs for both businesses and individuals.

This would negatively impact household budgets and business profitability, potentially slowing down economic growth.

In contrast, countries like Australia and New Zealand have raised interest rates in response to soaring inflation and high living costs.

However, Prof. Prasad pointed out that these countries face different economic conditions with inflation running particularly high.

The government’s approach, the minister argued, has been more measured with a focus on supporting growth through low interest rates.

The Reserve Bank, as an independent institution, conducts monthly assessments of the economic landscape and adjusts its policies accordingly.

The Finance Minister also reiterated that the government’s approach has been one of prudence, ensuring that the policies implemented are in the best interests of the people.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava