The Cabinet has now largely agreed to the required revenue measures to be implemented in the 2023–24 Budget.

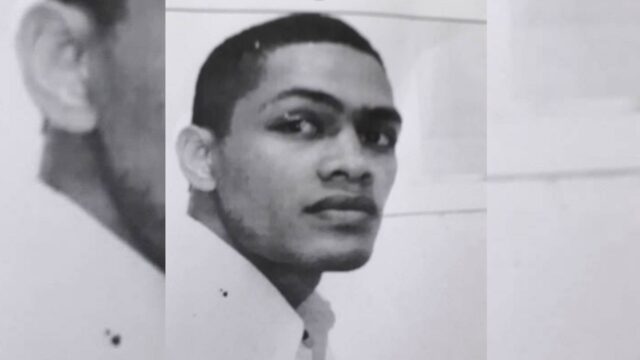

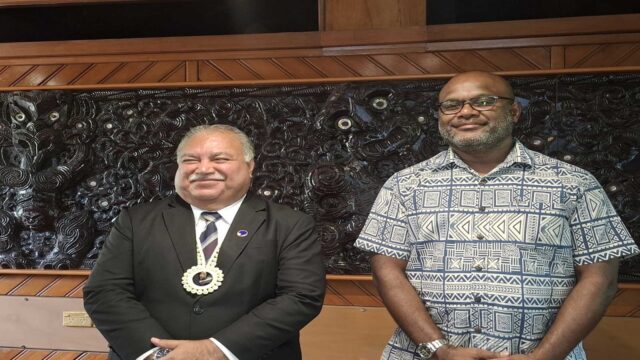

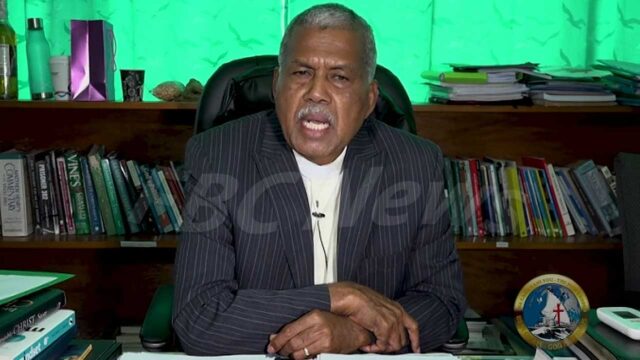

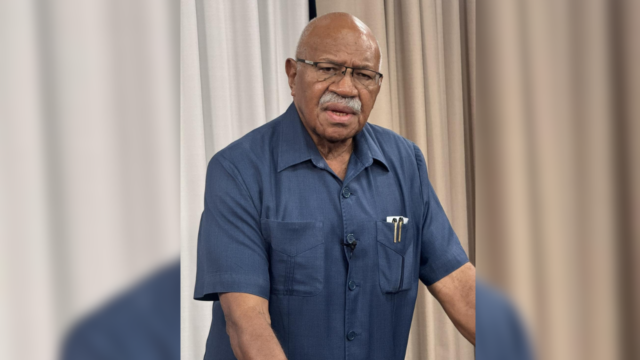

Speaking during the Fiji Institute of Chartered Accountants Congress 2023, Finance Minister Professor Biman Prasad shared the broad direction of some of those measures.

Prasad says the government has very few choices outside of increasing Value Added Tax.

He adds that the Government needs at least $500 million in additional revenue if it is to begin to make any difference in its fiscal status.

Professor Prasad says they will be raising the main corporate tax rate, which will collect an additional $70 million a year.

He adds that many people will be surprised at how low that number is, but that is all they will get from that increase.

The government will also be phasing in increases in departure tax between now and 2025 in consultation with the tourism industry.

Professor Prasad says this will raise an additional $70 million when it is fully implemented, but full implementation is still more than a year away.

The Finance Minister says that increases in Customs and excise duty, including on alcohol, will generate about another $100 million.

Prasad says in the area of personal tax, there are fewer than 300 people who have more than $270,000 a year in taxable income.

He adds that these are the individuals who pay the so-called “Social Responsibility Tax,” And they contribute nearly $30 million a year in tax on their own.

However, he adds that there are distortions that they will have to fix.

Professor Prasad says there are many more people who earn these levels of income, however, many of them pay much less personal tax because they take most of their income in tax-free dividends.

According to Prasad, this must change, and the Government will be asking them to contribute more.

He adds that they will have to work on a dividend taxation policy and will be consulting widely on this.

Prasad says that after considering all the options, they have decided that the current rate of 9% VAT will increase, and he will detail that more in the Budget address.

He adds there will be two rates because the government will leave zero-rating where it is and increase support for people currently on the social welfare system, because they are the ones who will be hardest hit by the increases.

He adds that the Prime Minister and Head of the Coalition Government, Sitiveni Rabuka, will also be making an address to the nation on some of these issues on Wednesday, June 28.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kreetika Kumar

Kreetika Kumar