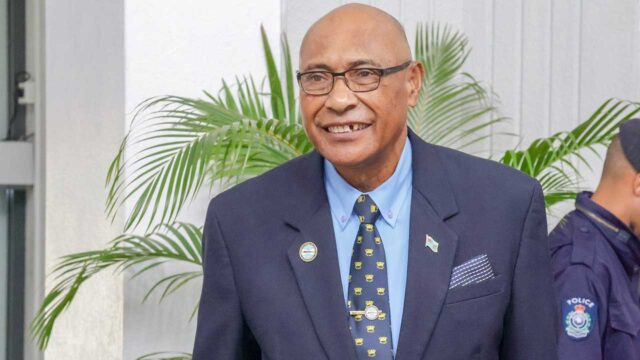

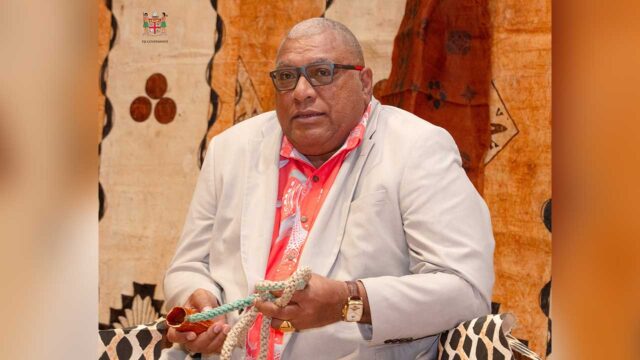

Finance Minister Professor Biman Prasad stresses that the government wants a tax and fiscal policy that provides certainty and confidence to the businesses and the private sector.

Prasad adds that in the last Budget they had indicated that they plan to introduce a dividend tax, both as a means of achieving equity between taxpayers and to raise revenue.

He states that after carefully listening to the opposing views and carefully weighing the potential revenue gain from this tax against the arguments raised, they have decided not to implement the dividend tax.

However, he says given the stable position of the tourism industry, they will increase the departure tax.

“As a pandemic measure, the departure tax was reduced from $200 to $100 while specific tourism taxes like STT and ECAL were abolished. In the last Budget, departure tax was increased from $100 to $140. Given the industry is in a much better position now, the departure tax will increase from $140 to $170, effective from 1st August 2024 and will return to the pre-pandemic rate of $200 from 1st August 2025.”

Effective from August 1st, the transit hours for departure tax exemption will reduce from 96 hours to 48 hours, (equivalent to two days).

At inception, the transit hours for departure tax exemption was 12 hours and later increased to 96 hours.

“For our hotel incentives, we are extending the SLIP tax holiday to investors who acquire existing hotels and undertake 70 renovations and refurbishments of more than $50 million. This will support major investments like Crowne Plaza and Wananavu resort. At a time when we need more capacity in the tourism sector, we encourage investors to take advantage of this.”

Prasad says in addition, the standard allowance for renovations and extension of hotels will be reduced from 50 percent to 25 percent, similar to pre-COVID levels.

He states that to support construction and bring down building costs, the fiscal duty on prefabricated buildings will reduce from 32 percent to five percent while fiscal duty on steel structures or articles of iron will be maintained at five percent.

Excise taxes on alcohol and tobacco products will increase by five percent.

Prasad adds the water resource tax rate will increase from one cent per litre to 5 cents per litre, for producers who extract between 0 to less than 10 million litres per month.

The rate for producers extracting over 10 million litres per month remains unchanged at 19.5 cents per litre which was increased from 18 cents per litre in the last Budget.

The government has also removed the three percent import duty on manufacturers bringing it back to zero.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap