The anticipation builds as the 2024-25 National Budget announcement will be announced in two hours, with citizens eagerly awaiting what is in store.

The Prime Minister and cabinet ministers, along with economists and non-governmental organizations, are optimistic, pointing to improved economic conditions compared to the current fiscal year.

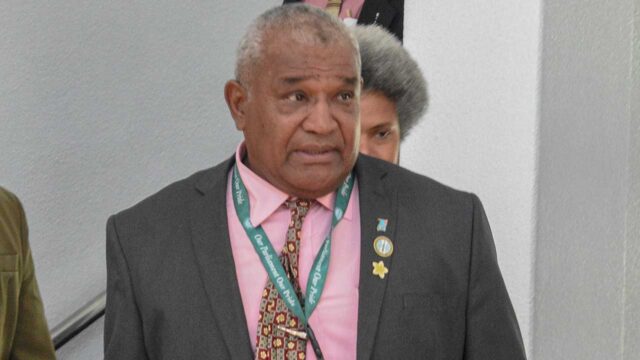

Finance Minister Professor Biman Prasad has hinted at a budget designed to ease financial burdens without unexpected changes.

His reassurance comes amidst widespread concern over household expenses, signaling a pivotal moment for the nation’s economic trajectory.

The government may not touch the VAT rate which stands at 15 percent, as there have been hints to impose tax on dividends and other distributions.

The Government is leaning towards a distribution tax, on both dividends and head office remittances, at a relatively low level, possibly in the range of five percent.

There is also a high chance of an increase in departure tax in 2025. It may be increased from $140 to $170.

A three percent import duty was imposed on manufacturers in the 2023-24 financial year, and the government is looking and bringing it back to zero.

For the first nine months of the current financial year (ie from August 2023 to April 2024), actual government expenditure was some $626m under budget.

Even if there is some catch-up in expenses in the last quarter of the current fiscal year (May, June and July), the expectation is that total expenses for the full year will most likely come under budget, suggesting the government is making some headway into cutting discretionary spending and addressing the underlying structural deficit problem.

On a disappointing note, revenue for the first three-quarters of the year, also came in lower by $175m VAT collections undershot target.

Nonetheless, the overall budget deficit position for the 2023-24 fiscal year is likely to see a significant improvement which would have lowered the government’s cash borrowing requirement and put further downward pressure on the debt/GDP ratio.

The Finance Minister has earlier alluded that they do not plan to change rates of personal, corporate or consumption tax.

Company tax and household income tax are doing better than expectations as a higher corporate tax rate and bracket creep – where households pay slightly more of their gross income in taxes as they move into higher income brackets – has seen revenue growth in direct taxes pick up pace the current fiscal year.

Expectations of around $600m in company and PAYE taxes for full year are likely to be easily exceeded and partially offset the falls in VAT receipts.

The capital budget is also tracking lower than budget but this could be due to capacity constraints in the contracting industry stemming from labour shortages.

However, with the government committing to addressing the infrastructure backlog and dedicated to tackling construction bottlenecks such as workforce gaps, more projects are likely to be rolled out over the next financial year which will see the capital spend turn around very quickly in 2024-25.

The budget will be delivered at 10am today.

Ritika Pratap

Ritika Pratap