Aerial shot of Suva City

The government in its budget announcement today has outlined reforms and plans to boost its revenue.

This includes an increase in tax revenue, which is largely driven by broad-based economic growth, strengthened compliance, and increases in departure tax rates, excise duties, and the water resource tax.

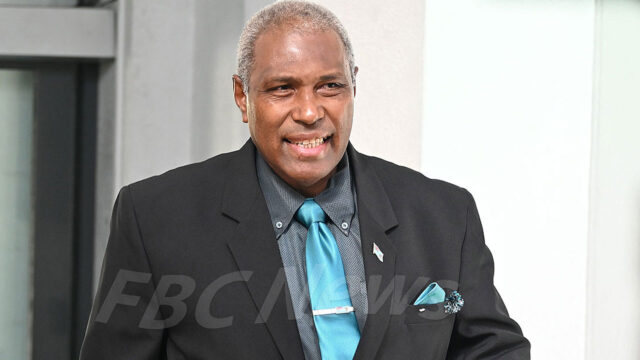

While delivering the 2024-2025 National Budget, Finance Minister Professor Biman Prasad stated that strengthening fiscal and debt sustainability remains a key priority for the coalition government.

The new budget sees government revenue increase from $3.7 billion to $3.9 billion, with an increase in expenditure from $4.3 billion to $4.5 billion.

Prasad says tax revenue collections are projected at $3.3 million for this financial year, an 8.7 percent increase compared to the last cycle.

“We should have a tax system that is simple, efficient, and fair and, as I have consistently maintained, with no surprises. We want a tax and fiscal policy that provides certainty and confidence to our businesses and the private sector.”

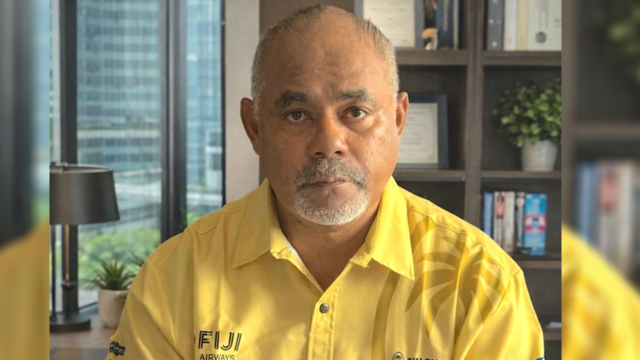

With the stable position of the tourism industry, increments are being implemented to boost revenue.

Effective August 1st, 2024, the transit hours for departure tax exemption will be reduced from 96 hours to 48 hours.

The water resource tax rate will increase from 1 cent per litre to 5 cents per litre for producers who extract between 0 to less than 10 million litres per month.

Meanwhile, people will now have to spend more money on alcohol and tobacco as the excise duty on both products has been increased by five percent.

This increase is expected to generate an estimated revenue gain of $6.1 million.

The government debt is projected to be 77.8 percent of GDP by the end of July 2025, while the net deficit stands at $635.4 million or -4.5 percent of GDP.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad