Nearly one billion dollars in outstanding scholarship bonds are currently owed to the Tertiary Scholarships and Loans Service Board.

This figure includes debts from graduates who have completed their studies and those still serving their bond periods.

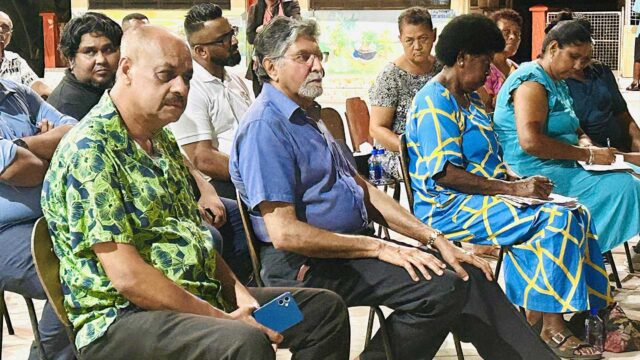

TSLS Chief Executive Hasmukh Lal states that there is widespread confusion about how loan agreements convert into bond agreements.

Many graduates, he explained mistakenly believe their loan is forgiven once they finish their studies. However, this is not the case.

The government’s scholarship assistance comes with the expectation of repayment.

To address this misunderstanding, Lal said TSLS was focusing on stricter monitoring and enforcement of bond obligations.

“The graduates are supposed to save the bond for a number of years, for example if they have done a degree for three years they need to save for four and a half years. If they don’t save, then they have to pay the apportioned amount with penalty”.

TSLS Chief Executive Hasmukh Lal

Graduates must honor these obligations, whether they are in Fiji or abroad.

Lal stated that graduates who travel overseas must pay a deposit and continue making monthly payments from their new country of residence.

But some are failing to keep up with their repayments.

“We are trying to strengthen the laws so that they don’t default, and they’re able to retain the taxpayers money invested in them through the legal agreement that they have signed.”

This is an issue TSLS is working hard to fix, particularly regarding the challenges of enforcing repayment from graduates living overseas.

Legal gaps are being addressed to ensure compliance and reduce defaults.

Lal also urges graduates to fully understand their bond agreements before leaving the country. Those who don’t could face complications including delays at the airport.

He adds that clear understanding of the terms and conditions is crucial to avoid these issues and ensure smooth travel.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainimili Magimagi

Sainimili Magimagi