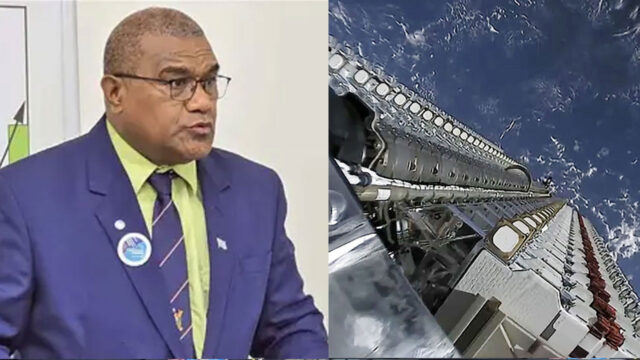

The South Pacific Business Development (SPBD) is in discussions with the Reserve Bank of Fiji about the possibility of becoming a microbank.

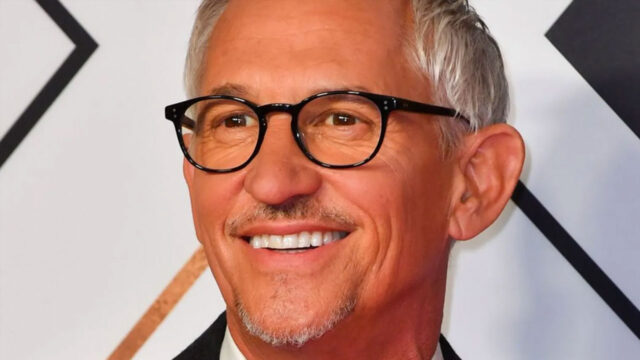

Speaking to FBC News, SPBD President Greg Casagrande stated that this initiative would enable the organization to provide its services to a wider Fijian population. He highlighted that SPBD has always been committed to improving the quality of life for underprivileged families by offering them meaningful economic opportunities.

Casagrande added that if SPBD becomes a microbank, it will be able to offer a broader range of lending and insurance-related services to its members.

“And we also look to provide a wider range of training services, lending services, saving services, and death benefit or insurance-related products to all of our members. We are in discussions with the Reserve Bank of Fiji, and this is perhaps a little bit further down the road to contemplate becoming a microbank, which would allow us to provide services not only to our members but to the broader Fijian population.”

He expressed gratitude for the support from the Reserve Bank of Fiji.

“The Reserve Bank of Fiji has consistently recognized SPBD as the leading provider of financial inclusion in both the country and the South Pacific region. They have been a very good partner of ours.”

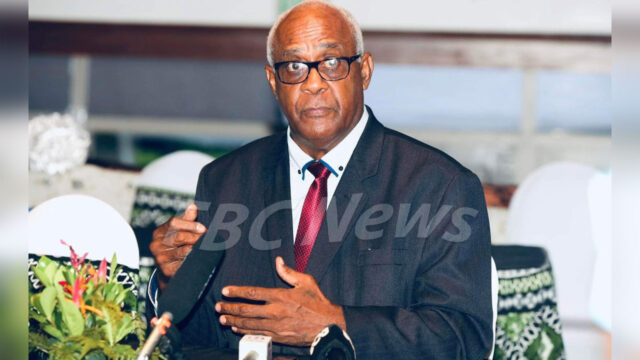

SPBD Director Elrico Munoz emphasized that SPBD is the only institution that continuously provides microfinance to women entrepreneurs.

“One of the things that sets SPBD apart from other financial institutions is that even if your business fails, we will still fund you. The next time you borrow, maybe this time it’s another business idea, but you already have a wealth of knowledge from your mistakes, so you will be doing it better.”

He added that their tireless efforts have transformed lives across the South Pacific, enabling over 115,000 women to embrace opportunities for sustainable income generation.

Riya Mala

Riya Mala