The Reserve Bank of Fiji has announced a historic financial achievement, recording it’s highest-ever profit of $135.5 million for this financial year.

Last year, the central bank made a record profit of $102 million.

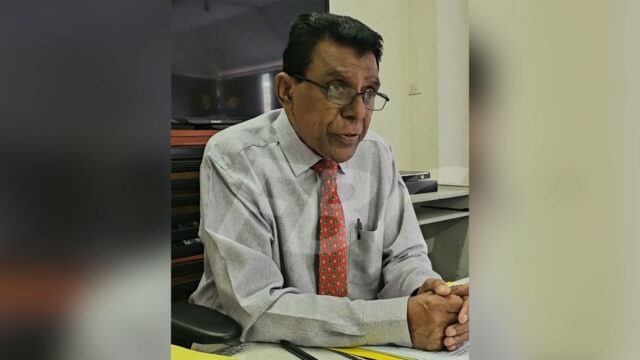

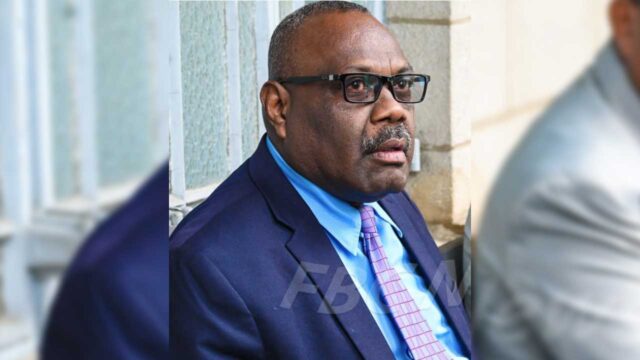

This, according to RBF Governor Ariff Ali marks the largest profit not only for the central bank but for any financial institution or government entity in Fiji.

He announced that $136.2 million will be transferred to the government and this is in line with the bank’s legal obligations to allocate one-fifth of its revaluation reserve to the State.

The RBF Governor emphasized the timeliness of this contribution, stating that the accounts were finalized six weeks ahead of the statutory deadline.

He says this early payment can save the government around $750,000 in interest.

Over the last decade, Ali says RBF has transferred nearly half a billion dollars to the government and since its establishment, the total contributions have been close to $1 billion.

Without these contributions, Fiji’s debt-to-GDP ratio would be approximately 10 per cent higher.

He says the Reserve Bank remains the only institution consistently returning profits to the government.

“Last year and this year, we’ve given a combined $240 million. This is about 2% of governments of GDP. So that means if you take into account debt-to-GDP ratio, we’ve reduced it by 2%.”

Ali also provided a positive economic update, revealing that Fiji’s economy grew by 7.5 per cent last year with expected growth this year to exceed three per cent.

Fiji’s foreign reserves reached a record high of $3.77 billion.

The Governor has assured Fijians that the financial institutions under the RBF’s supervision are strong and stable with total assets exceeding $30 billion.

However, the Governor also cautioned that another record profit next year might not be guaranteed, as global interest rates are on a decline including a recent half-percent cut by the US Federal Reserve.

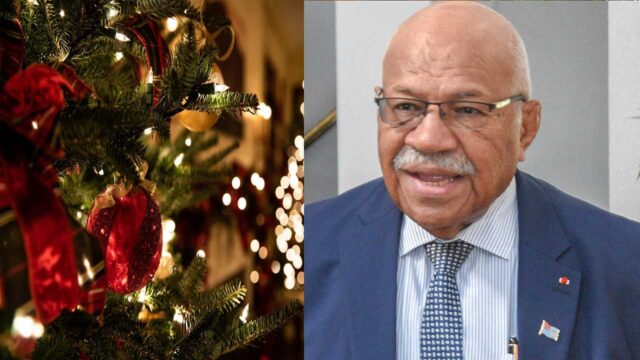

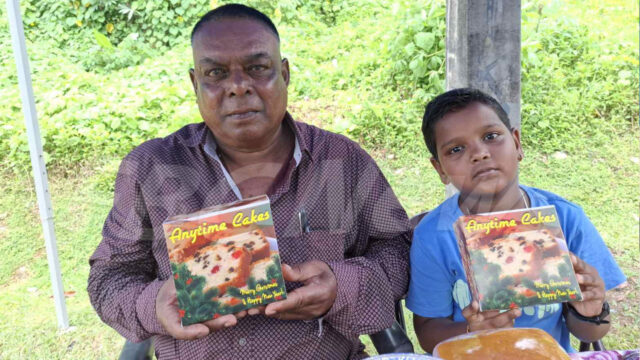

Deputy Prime Minister and Minister of Finance Professor Biman Prasad pointed out that the RBF’s work in monitoring foreign reserves, interest rates and inflation is vital to ensuring fiscal stability.

“One thing that we have to be very grateful to ourselves and to the work of the Reserve Bank, the board, is that we’ve managed to keep our interest rate low with the accommodative monetary policy stance.”

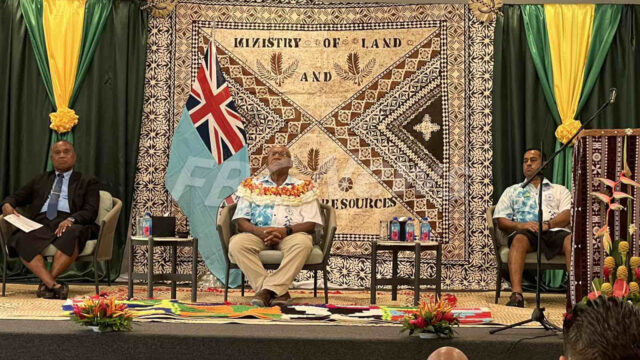

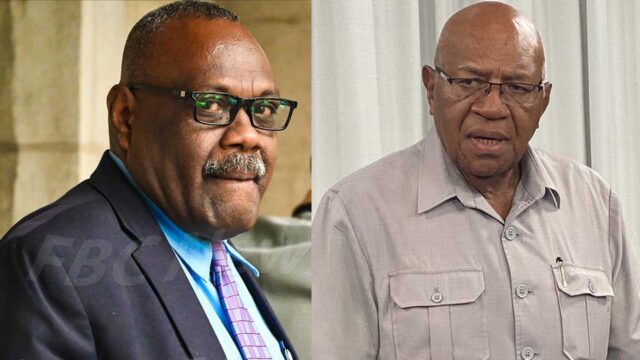

Prime Minister Sitiveni Rabuka states it is noteworthy that the bank has managed to achieve high profits while fulfilling its primary roles of maintaining foreign reserves and ensuring inflation stability.

“The growth is not only a reflection of the sound and effective management. I must say happy management of the monetary policies of the Reserve Bank of Fiji, but also of Fiji’s resilience in economic stability and steady growth over the years.”

The PM also gave emphasis to the importance of the Reserve Bank’s regulatory role in the financial sector and its contribution to significant reforms including improvements to Fiji’s payment system.

Litia Cava

Litia Cava