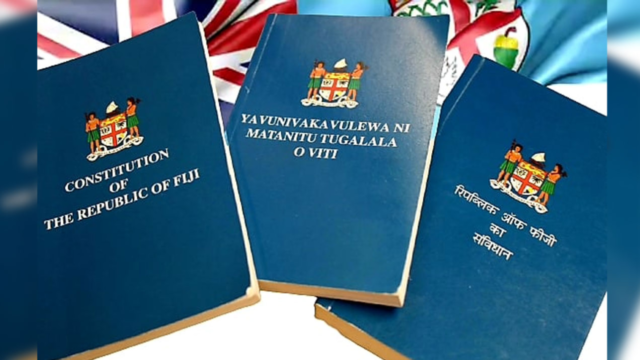

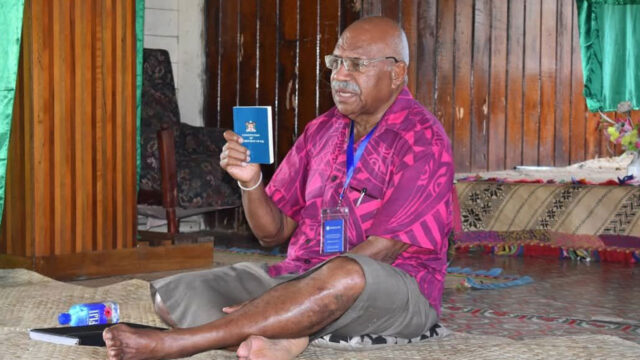

[File Photo]

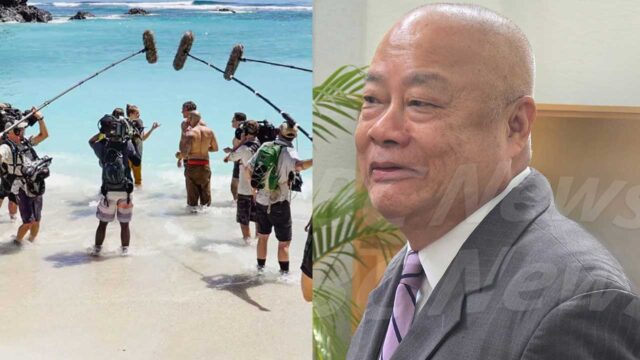

The International Monetary Fund Executive Board have welcomed the strong economic rebound in Fiji driven by the recovery in tourism.

They noted, however, downside risks to the outlook given Fiji’s vulnerability to a slowdown in tourism, commodity price shocks, and climate change.

The directors are emphasizing the importance of pursuing sound macroeconomic management, while advancing efforts to address structural challenges related to fiscal buffers, resilience and inclusive growth.

They commended the authorities for implementing significant revenue-enhancing measures in the Financial Year 2024 budget to reduce the fiscal deficit, reverse the debt trajectory, and finance increased social spending.

They stress that continued gradual fiscal consolidation is critical to rebuild fiscal buffers to respond to future shocks and to place debt firmly on a downward path.

The directors also emphasize the need to further increase revenue mobilization and expenditure efficiency, including by better targeting social spending and improving public investment capacity.

They concurred that strengthening oversight of state-owned enterprises and reinforcing the fiscal institutional framework can help protect Fiji’s fiscal sustainability.

Noting excess liquidity and the closing negative output gap, Directors are encouraging the authorities to gradually shift monetary policy to a neutral stance to create policy space, supported by a proactive communication strategy.

They says that developing a more effective monetary transmission mechanism will also be important.

The Directors are encouraging reversing the remaining pandemic-related current account exchange restrictions and capital flow management measures, and phasing out the pre-pandemic exchange restrictions.

While noting that the financial sector remains sound, the Directors are also stressing the importance of further enhancing financial sector oversight, particularly for banks with high non-performing loans.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap