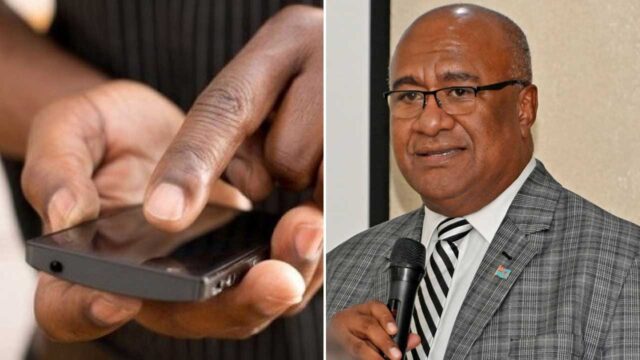

Deputy Prime Minister, Hon. Manoa Kamikamica and CEO of HFC Bank, Mr. Rakesh Ram [Source: Supplied]

The local Micro Small and Medium Enterprises will be getting more assistance.

HFC Bank has partnered with Business Link Pacific, under the auspices of DT Global New Zealand Limited and sponsored by the New Zealand Government’s Ministry of Foreign Affairs and Trade.

This collaboration aims to bolster the support available to small and medium enterprises in Fiji.

Under this strategic alliance, BLP has pledged two million dollar to support SME loans, all of which will be assessed through HFC Bank.

This partnership includes a 50 percent underwriting guarantee from BLP against potential bad debts.

In response to market needs, the product offering has been refined to increase the SME loan limit from $50,000 to $200,000 per customer.

Additionally, recognizing the challenges SMEs face in providing equity,

BLP will contribute up to $20,000 as equity per customer.

Since the inception of this partnership, HFC Bank has extended up to $1.1 million in loans to the SME sector, demonstrating a steadfast commitment to enhancing access to finance for small businesses.

Deputy Prime Minister, Manoa Kamikamica says the introduction of a supplementary “Loan Equity Guarantee” further strengthens this initiative, with BLP providing supplementary loan equity shortfalls up to $20,000, ensuring the minimum equity requirement of 10% for SME loans is met.

Kamikamica says this initiative sits well in terms of the Government ambitions to develop a comprehensive MSME ecosystem in Fiji and push the share of GDP to 30% in the next 10 years.

HFC Bank CEO, Rakesh Ram says the partnership extends beyond financial aid, engaging Business Assistance Fiji (BAF) to assist SMEs with preparing business cash flow forecasts, financial statements, business plans, and proposals at no cost.

Ritika Pratap

Ritika Pratap