Parliament has approved a significant increase in the government guarantee limit for the Fiji Sugar Corporation.

The guarantee limit for FSC’s borrowings has been raised by $105 million to a total of $200 million for the period from August 1, 2022, to May 31, 2028.

Additionally, FSC has been exempted from paying the guarantee fee.

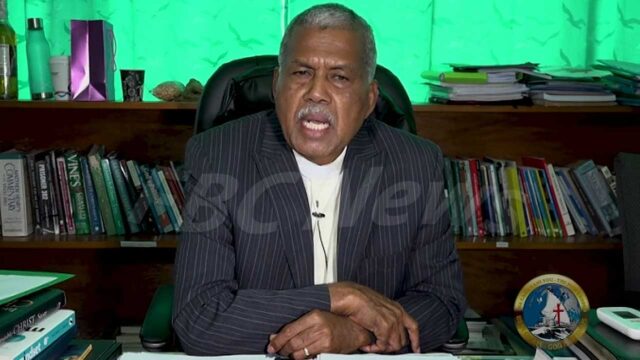

Deputy Prime Minister and Finance Minister Professor Biman Prasad [Source: Parliament of Fiji/ Facebook]

Deputy Prime Minister and Finance Minister Professor Biman Prasad says that FSC has previously received government guarantees for domestic and offshore borrowings.

The most recent domestic guarantee of $95 million was approved by Parliament in May this year.

However, FSC has exhausted this limit.

The offshore guarantee, initially approved in 2017, covers a $50.4 million loan from the Exim Bank and Bank of India until December 2028.

“We as a Government are determined to look at the industry. I think the honourable Minister for Sugar, having inherited such a difficult proposition, and I do not envy his job trying to get to the workers, trying to get to the farmers, trying to address the concerns of what is happening in the mills with aging infrastructure, aging machines and spare parts. These are real problems within the milling sector then of course, we have the same issue at the farm level; issues of labour, farm practices. These things have not changed and that is why I kept referring to that period that we lost a very critical moment in Fiji’s sugar industry history which was not taken on.”

Professor Prasad states that FSC’s financial struggles have been severe with the corporation operating at less than 50 percent of its target crop.

Despite efforts to improve, he says FSC has faced numerous challenges including natural disasters, fluctuating world sugar prices, and operational inefficiencies.

The corporation’s financial health has been deteriorating with continuous net losses over the past decade.

In the fiscal year 2023, FSC incurred a net loss of $23 million, down from $44.3 million in 2022.

As of May 31, 2024, FSC’s total liabilities stand at $293 million, exceeding its asset base and indicating insolvency.

The government’s total guaranteed debt is projected to rise to $1.1 billion, representing 7.9 percent of GDP with FSC’s guaranteed borrowings contributing significantly to this total.

In light of these challenges, Professor Prasad says that the government is working with FSC to address fiscal risks.

The Ministry of Finance is working with the Food and Agriculture Organization (FAO) to conduct a comprehensive study of the sugar industry. This study aims to provide new insights and solutions to stabilize and improve FSC’s operations.

Independent MP Semi Koroilavesau says there is a need for a special committee to address longstanding issues within the sugar industry, suggesting that previous oversight and coordination have been insufficient.

He called for a thorough review to improve the sector’s performance and sustainability.

Sugar Minister Charan Jeath Singh noted ongoing efforts to stabilize the industry, including resolving land lease issues and promoting modern farming techniques.

He says the focus is on supporting farmers and enhancing efficiency to ensure a stable future for the sugar sector.

Deputy Prime Minister and Minister for Trade Manoa Kamikamica expressed optimism that this move would address critical issues in the sugar industry, acknowledging past reluctance to fully address these problems.

Prof Prasad reiterates that the government remains committed to examining the industry thoroughly and implementing necessary reforms once the FAO report is available.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava