[File Photo]

The Fiji Revenue and Customs Service has set its sights on significantly increasing the number of tax-compliant micro, small, and medium enterprises and enhancing their contribution to the economy.

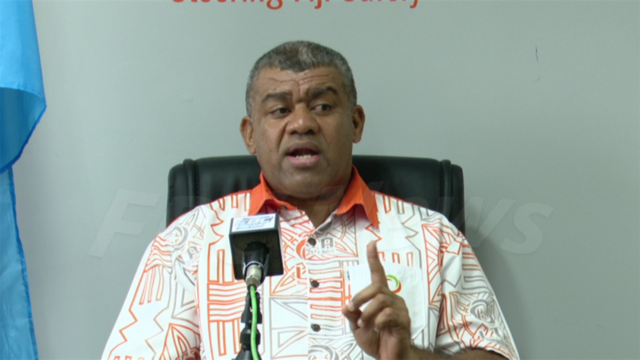

Chief Executive Udit Singh reveals that approximately 117,000 MSMEs are registered with the FRCS and of these around 22,800 are currently tax-compliant, collectively contributing approximately $59 million in taxes annually.

“We have seen that majority of the MSMEs want to be tax compliant. However, they lack awareness on tax processes which hinders them to be compliant. They also face a number of challenges, including misinterpretation of tax laws, difficulty accessing tax incentives, and exemption and the need to simplify the tax system.”

Singh says they have initiated training programs focused on basic tax financial literacy to address this issue.

“Through our training on basic tax financial literacy in our taxpayer online portal, we are empowering small business communities to acknowledge and enhance the tax requirements and make them self-sufficient and independent. With this strategy, we intend to increase the taxpaying MSMEs in Fiji to 22, 800. This will surely increase revenues as well as expansion and development of our economy.”

Founder of Healthy Eating and Nutritionist Victoria Pasca who started business seven years ago says the training has been valuable.

“I learnt that there were some measures that were applicable to MSME, I was not aware of that so it’s really great, you don’t invest too much of your time.”

The FRCS has so far provided tax financial literacy to around 3000 MSME representatives.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash