[Source: Reuters]

Samsung Electronics (005930.KS), said it is looking to drive growth as it faced tough questions from shareholders after its failure to ride an artificial intelligence boom made it one of the worst-performing tech stocks last year.

The South Korean firm has been suffering from weak earnings and sagging share prices in recent quarters after falling behind rivals in advanced memory chips and contract chip manufacturing, which have enjoyed strong demand from AI projects.

In internal meetings, Samsung has acknowledged it has lost ground. This is particularly true in semiconductors, where it lags SK Hynix (000660.KS), opens new tab in high bandwidth memory (HBM) chips that Nvidia (NVDA.O), opens new tab and others rely on for AI graphic processing units.

Samsung co-CEO Han Jong-hee told investors on Wednesday that 2025 would be a difficult year because of uncertainties surrounding economic policies in major economies and that Samsung would pursue “meaningful” mergers and acquisitions and try to produce tangible achievements.

Shares in Samsung tumbled by nearly a third last year while those of SK Hynix climbed 26%. In recent years, Samsung has also lost market share to TSMC (2330.TW), opens new tab in contract chip manufacturing and to Apple (AAPL.O), opens new tab and Chinese rivals in smartphones.

Samsung launched a share buyback plan worth 10 trillion won ($7.2 billion) in November after its stock plunged to more than four-year lows. Its shares have gained 7% since then.

Samsung is South Korea’s most valuable company, with its market capitalisation of $235 billion accounting for 16% of the total value of the country’s main bourse. Nearly 40% of investors in South Korean stocks own Samsung shares, according to market data.

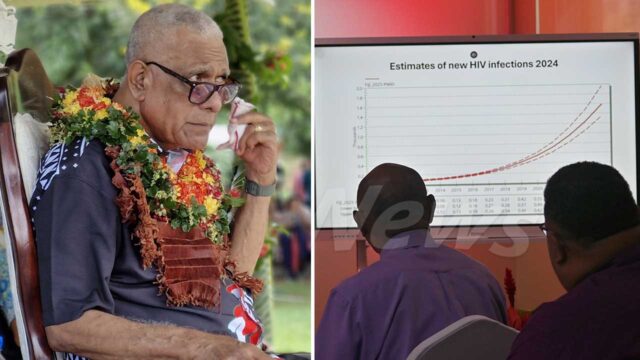

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters