The government will work closely with the consumer watchdog to assess the need for legislative changes aimed at improving the efficiency and effectiveness of insurance services.

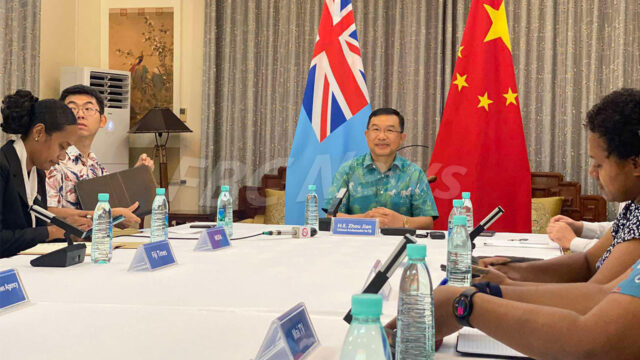

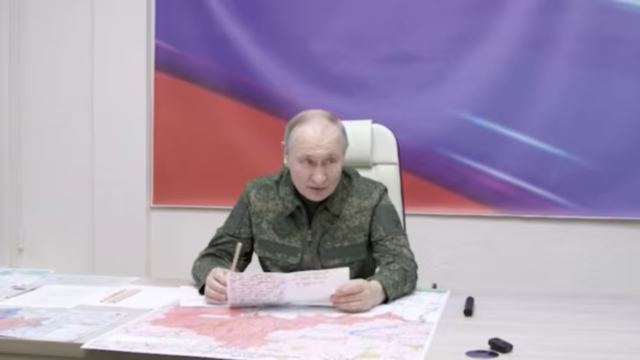

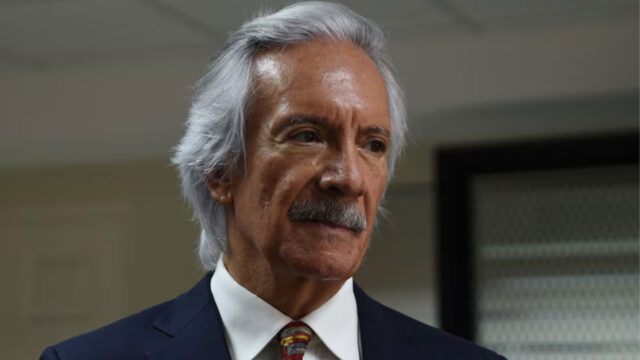

Deputy Prime Minister and Finance Minister Professor Biman Prasad addressed these concerns in Parliament while responding to the Reserve Bank of Fiji Insurance 2023 Annual Report.

Prof Prasad says while the insurance sector has seen positive growth, there are still challenges in health insurance.

Things like upfront payments. Insurance companies moving away from bulk billing. Consumers have to pay out front. Sometimes, you know they have to run around to make the claims. So, these are issues that are still there

Prof Prasad assures that they are committed to addressing these challenges.

The Government, Mr. Speaker, Sir, is going to look at working very closely with the Consumer Council of Fiji to see if there is a need to change the Act to ensure that there is flexibility, efficiency and effectiveness in the service that insurance company’s deliver, then we will definitely do that.

The insurance industry has shown strong growth in 2023 and 2024, with a positive outlook for 2025, driven by a stable economy, the absence of major natural disasters, and government policies boosting household incomes.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash