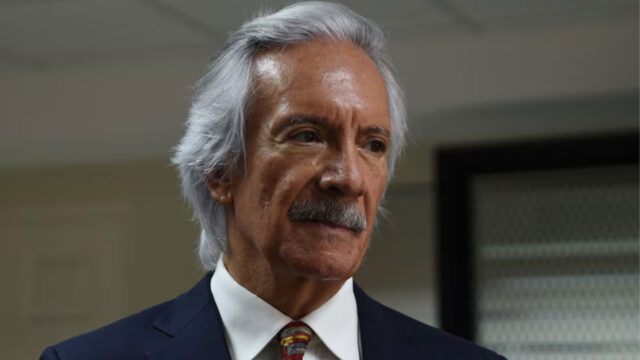

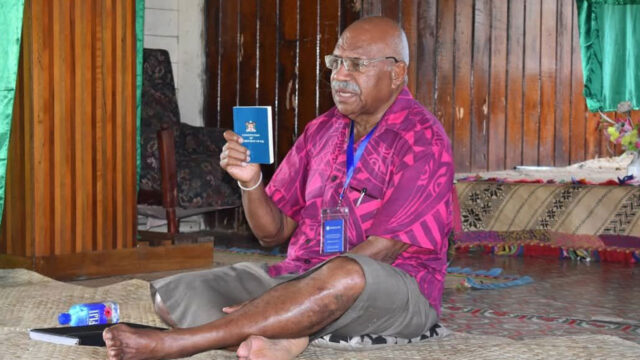

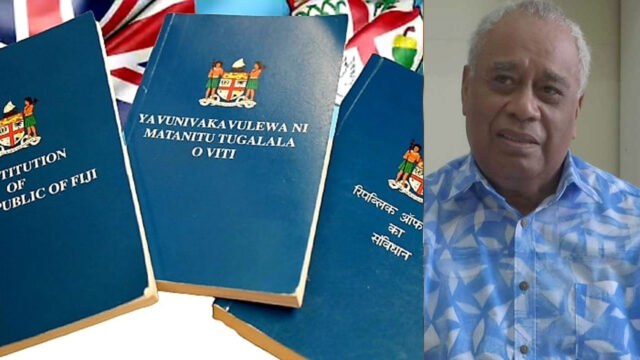

Deputy Prime Minister and Finance Minister Professor Biman Prasad.

The insurance industry has experienced substantial growth in recent years, with positive trends expected to continue.

Deputy Prime Minister and Finance Minister Professor Biman Prasad highlighted this while responding to the Reserve Bank of Fiji Insurance 2023 Annual Report.

Prasad credited the growth to favorable economic conditions, as well as government policies aimed at boosting household incomes and consumer spending.

If you go by the growth in the industry in 2023 and 2024, Mr. Speaker, Sir, it does gel with the economic performance, but it also suggests, contrary to popular misinformation and given the measures that we have put in place in the 2024- 2025 Budget, in-crease in the minimum wages, again going to $5 from 1st of April, increase in the salaries of the Civil Service since 2017, all that, Mr. Speaker, Sir, has added additional income to households, to people and that is reflected in the growth of the insurance industry.

Prasad also highlighted the establishment of the Office of the Financial Services Ombudsman within the Reserve Bank of Fiji as an important development for protecting consumers.

He says the ombudsman serves as an impartial platform for resolving disputes and the Financial Services Ombudsman is tasked with investigating, mediating and ensuring fair resolutions between consumers and financial services.

In 2023, the Ombudsman successfully resolved 10 out of 11 complaints related to the insurance sector, leading to payouts for consumers.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash