[Source: Reuters]

Chinese and Indian refiners will source more oil from the Middle East, Africa and the Americas, boosting prices and freight costs, as new U.S. sanctions on Russian producers and ships curb supplies to Moscow’s top customers, traders and analysts said.

The U.S. Treasury on Friday imposed sanctions on Russian oil producers Gazprom Neft (SIBN.MM), opens new tab and Surgutneftegas, as well as 183 vessels that have shipped Russian oil, targeting the revenues Moscow has used to fund its war with Ukraine.

Many of the tankers have been used to ship oil to India and China as Western sanctions and a price cap imposed by the Group of Seven countries in 2022 shifted trade in Russian oil from Europe to Asia. Some tankers have also shipped oil from Iran, which is also under sanctions.

Russian oil exports will be hurt severely by the new sanctions, which will force Chinese independent refiners to cut refining output going forward, two Chinese trade sources said. The sources declined to be named as they are not authorised to speak to media.

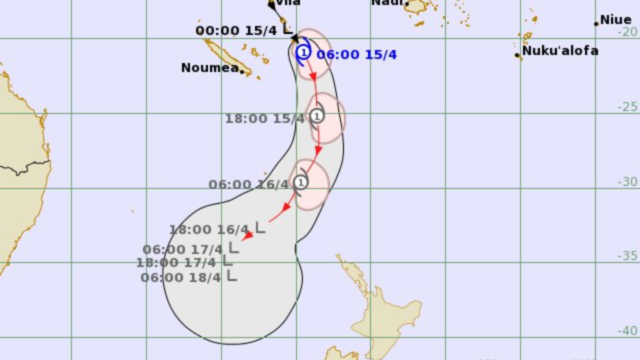

The expected disruption in Russian supply drove global oil prices to their highest in months on Monday, with Brent trading above $81 a barrel.

Among the newly sanctioned ships, 143 are oil tankers that handled more than 530 million barrels of Russian crude last year, about 42% of the country’s total seaborne crude exports, Kpler’s lead freight analyst Matt Wright said in a note.

Of these, about 300 million barrels were shipped to China while the bulk of the remainder went to India, he added.

A Singapore-based trader said the designated tankers shipped close to 900,000 bpd of Russian crude to China over the past 12 months.

For the first 11 months last year, India’s Russian crude imports rose 4.5% on year to 1.764 million bpd, or 36% of India’s total imports. China’s volume, including pipeline supply, was up 2% at 99.09 million metric tons (2.159 million bpd), or 20% of its total imports, over the same period.

China’s imports are mostly Russian ESPO Blend crude, sold above the price cap, while India buys mostly Urals oil.

Vortexa analyst Emma Li said Russian ESPO Blend crude exports would be halted if the sanctions were strictly enforced, but it would depend on whether U.S. President-elect Donald Trump lifted the embargo and also whether China acknowledged the sanctions.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters