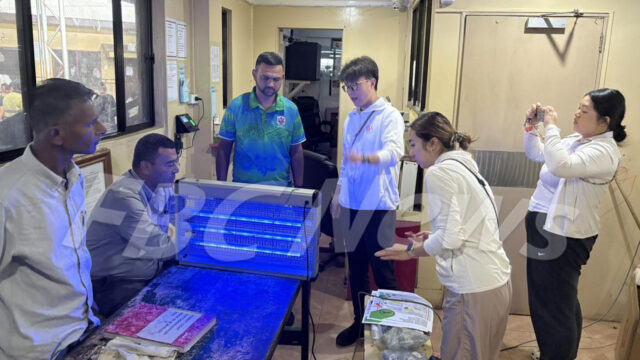

The newly formed Fiji Revenue and Custom Services Crime Task Force will now take appropriate measures to ensure that legitimate taxes are accurately collected.

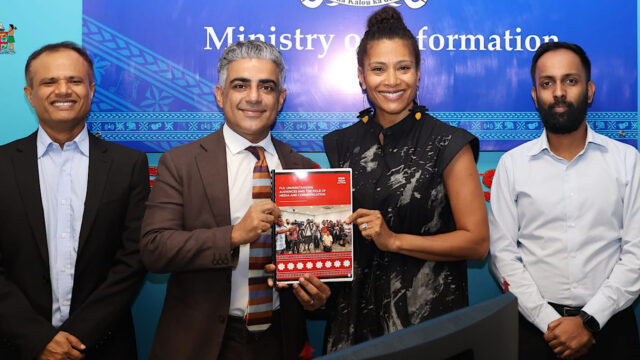

Taskforce Chair Nitin Gandhi says they will address tax evasion cases that have led to revenue losses for the government over the years through an evidence-based approach.

While these figures have not been revealed, the Taskforce Chair says tax avoidance and evasion pose a significant threat to the integrity of the tax systems and the overall economic stability of the nation.

“This task force aims to prevent, detect and address tax evasion while further strengthening tax compliance. More specifically, the task force will review and recommend improvements to existing legislation and processes, review current processes and redevelop frameworks for investigating, enforcing and prosecuting undisclosed income and financial non-compliance”

Gandhi says they will further collaborate with key agencies to address tax evasion and financial crimes.

“Where there are suspicions of money laundering or unreported proceeds of crime, the task force will promptly refer these matters to the appropriate agencies for further investigation and action”

He says the task force will utilize evidence-based information from various sources to support.

The taskforce will implement measures to protect revenue and ensure compliance with legal standards and maintain strict data privacy and security protocols.

The taskforce includes former FRCS CEO Jitoko Tikolevu, former Acting Commissioner of Police Rusiate Tudravu, Anti-Corruption and Governance Expert Avinash Raman and Risk and Financial Management Expert Pramesh Sharma.

The task force will operate in collaboration with the Fiji Financial Intelligence Unit, the Fiji Independent Commission against Corruption, Fiji Police Force, the Director of Public Prosecutions and other relevant agencies including international partners Australia and New Zealand.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash