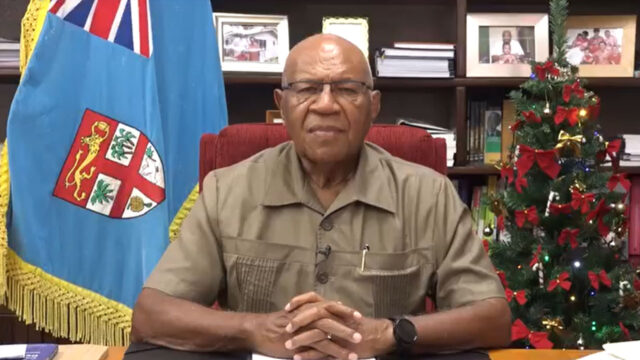

Fiji is set to make history with tax revenue collections expected to exceed projections of $3.3b for the first time, says Deputy Prime Minister and Finance Minister Professor Biman Prasad.

Speaking at the inaugural meeting of the Fiji Revenue and Customs Service Tax Crimes Taskforce, Prasad highlighted the country’s strong fiscal performance, noting that tax collections in the last four months have been very positive.

“We crossed the $3 billion tax revenue collection for the first time last financial year. Tax collections in the last four months have shown very good results. In fact, we are above forecast. And I think that for the first time, probably in the history of this country, we would have collected tax revenue above the budgeted forecast.”

Professor Prasad attributed these successes to reforms implemented over the past two years.

The finance minister stresses that the revenue surplus reflects a shift from past practices where overambitious revenue targets led to rising deficits and growing debt.

“We are not exaggerating that our forecast, our targets in the budget, are sensible based on realistic, and you know, assessment. And that’s the most important thing about budgets: that you provide a budget that is realistic, that is based on better assessment.”

Professor Prasad says they are funding the government appropriately, ensuring that resources are allocated to critical sectors like health, education, and infrastructure without relying excessively on borrowing.

He says that borrowing, while necessary at times, burdens future generations and diverts funds from essential public services due to rising debt servicing costs, which now consume a quarter of the national budget.

Fiji Revenue and Customs Services Chief Executive Udit Singh says economic indicators such as tourism and growing business confidence are positively impacting tax revenue.

Fiji Revenue and Customs Services Chief Executive, Udit Singh

“We’ve had some strong movement in the economy in terms of all of the indicators from tourism, just a general sort of swell in terms of business confidence, and we’ve seen that come through in some of the tax collections. We’ve also had quite a few efforts in terms of collecting taxes, a lot of initiatives that our team has been putting together. So we’re seeing that come through.”

The FRCS, alongside the newly launched Tax Crimes Taskforce, aims to sustain these achievements by continuing to improve compliance and address financial irregularities.

Praneeta Prakash

Praneeta Prakash