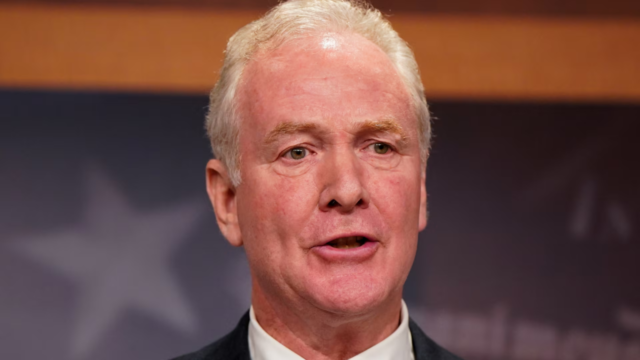

[Source: Reuters]

President-elect Donald Trump on Monday pledged big tariffs on the United States’ three largest trading partners – Canada, Mexico and China – detailing how he will implement campaign promises that could trigger trade wars.

Trump, who takes office on Jan. 20, 2025, said he would impose a 25% tariff on Canada and Mexico until they clamp down on drugs, particularly fentanyl, and migrants crossing the border, in a move that would appear to violate a free-trade deal.

Trump also outlined “an additional 10% tariff, above any additional tariffs” on China, in some of his most specific comments on how he will implement his economic agenda since winning the Nov. 5 election on promises to “put America first”.

While migrant arrests reached a record during President Joe Biden’s presidency, straining U.S. border enforcement, illegal crossings fell dramatically this year as Biden instituted new border restrictions and Mexico stepped up enforcement.

More than 83% of exports from Mexico went to the U.S. in 2023 and 75% of Canadian exports went to the country. Trump’s threatened new tariff would appear to violate the terms of the U.S.-Mexico-Canada Agreement on trade. The deal that Trump signed into law took effect in 2020 and continued the largely duty-free trade between the three countries.

Canada and the United States at one point imposed sanctions on each others’ products during the rancorous talks that eventually led to USMCA. Trump will have the opportunity to renegotiate the agreement in 2026 when a “sunset” provision will force either a withdrawal or talks on changes to the pact.

After issuing his tariff threat, Trump held a conversation with Canada’s Prime Minister Justin Trudeau in which they discussed trade and border security, a Canadian source familiar with the situation said.

Trump could be counting on the threat of tariffs to prompt an early renegotiation of USMCA, said William Reinsch, a former president of the National Foreign Trade Council.

Trump’s announcement sparked a dollar rally. It rose 1% against the Canadian dollar and 2% against the Mexican peso, while share markets in Asia fell, as did European equity futures. S&P 500 futures fell 0.3%.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters