The Fiji National Provident Fund will be implementing key changes to its penalty system for late contribution payments, from 1st January next year.

In addition, the penalties paid will be allocated directly to the affected member’s account.

These changes to the FNPF Act 2011, were approved by Parliament in July.

The current penalty regime of $100 per employee per month, has been in place since November 2011.

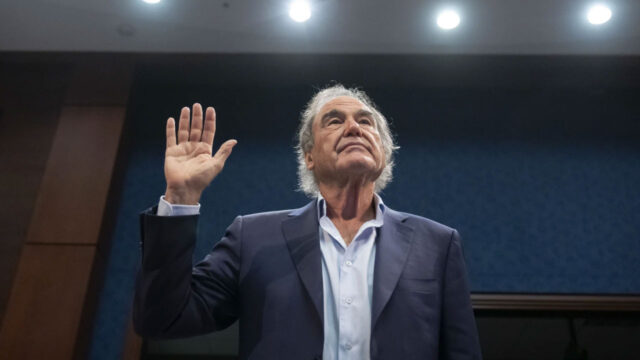

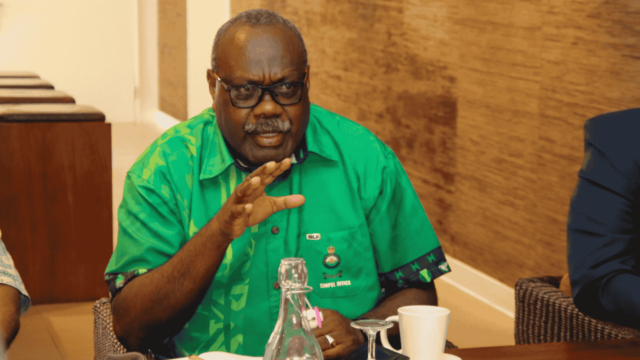

FNPF CEO Viliame Vodonaivalu

FNPF Chief Executive Viliame Vodonaivalu says from 1st January 2025, a 10 percent monthly penalty will be applied to outstanding contributions, including December 2024 contributions.

He says the penalty will be calculated on the balance of unpaid contributions and will be applied each month until the debt is settled.

Vodonaivalu says the revised penalty regime was practical as it was a fair and equitable approach, transitioning from a one-rule-for-all penalty regime.

He says the existing penalty system has remained unchanged despite the significant development in the business landscape, especially with emerging segments and industries.

The FNPF CEO says while it has served its purpose, they believe that this new system will be more manageable for employers.

He says this new penalty structure will undoubtedly reduce the burden on micro, small and medium enterprises, while maintaining greater accountability for larger organizations.

Vodonaivalu says moving forward all penalties collected will be directly allocated to members’ accounts, helping to strengthen their retirement savings.

In addition to the new penalty system, all Contribution Schedule will have to be submitted by the 14th of each month.

This change is also effective from 1st January 2025.

This allows employers with more time to raise their invoices and process payments before the due date at the end of month.

He says to help employers clear any outstanding debts before the new penalties take effect, a Penalty Waiver Amnesty is in place until the end of the year 31st December.

He is encouraging all employers to take advantage of the amnesty period to clear any outstanding debts before the new penalty system begins in January 2025.

Vodonaivalu says employers who do not take advantage of the amnesty period will be subjected to the current and new penalties which means that the current penalty of $100 per employee will apply to November 2024 contributions, while the new penalty will apply to December 2024 contributions.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash