The Reserve Bank of Fiji’s annual profit transfer to the government plays a vital role in funding key national programs and infrastructure projects.

This year, RBF transferred approximately $136 million, slightly higher than the amount initially projected in the national budget.

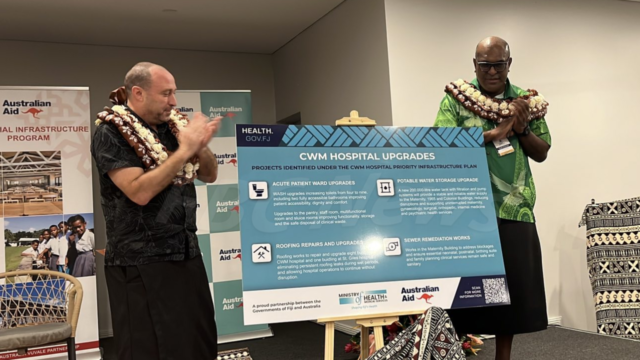

These funds are critical in supporting social welfare payments, education, bus fare subsidies and the development of infrastructure including hospitals.

Without this contribution, the government would have had to borrow the equivalent amount, leading to higher interest costs and a greater financial burden on taxpayers.

RBF Governor Ariff Ali explained that the Reserve Bank’s profits are largely derived from its investments in foreign reserves which total $3.7 billion.

These reserves, he says are invested in a basket of major currencies including the Australian dollar, New Zealand dollar, US dollar, Japanese Yen and Euro.

“Central banks normally take a very conservative approach, because this is the nation’s reserves and not our reserves. So we don’t take risks, we try to be as prudent as possible. Our key parameters in terms of investing foreign reserves, making sure that one, the number one priority is safety.”

The bank, Ali says takes a conservative approach to ensure the security and liquidity of these investments, focusing on safety rather than chasing high returns.

This prudence, he says ensures that Fiji’s reserves are protected and provide steady income.

In addition to foreign investments, the governor says RBF earns income from domestic activities.

It also charges interest on loans to commercial banks and collects fees for licensing financial institutions.

Other revenue sources include rent from tenants in the Reserve Bank building and sales of numismatic coins and notes.

However, he says these income streams are relatively minor compared to the revenue generated from foreign reserves.

Ali states that the Reserve Bank’s risk management practices are stringent with dedicated committees overseeing the institution’s exposure to various risks.

This careful management, according to Ali ensures that the bank operates securely while maintaining its role as a key financial institution.

The funds provided by RBF allow the government to avoid additional borrowing and interest costs, supporting the budget in areas of social welfare, education and infrastructure development.

Ali adds that the prudent management of foreign reserves and risks ensures that RBF remains a reliable contributor to Fiji’s financial stability.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

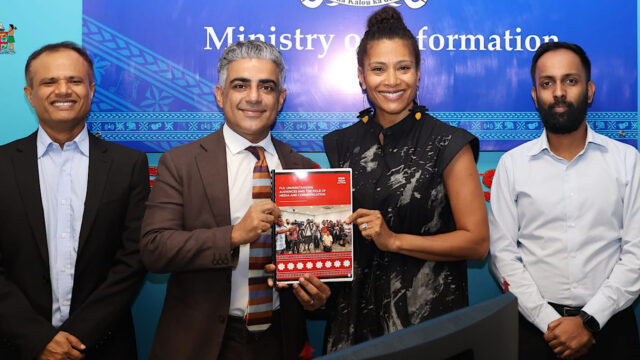

Litia Cava

Litia Cava