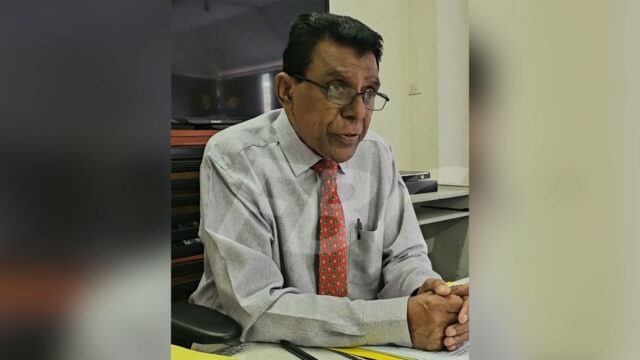

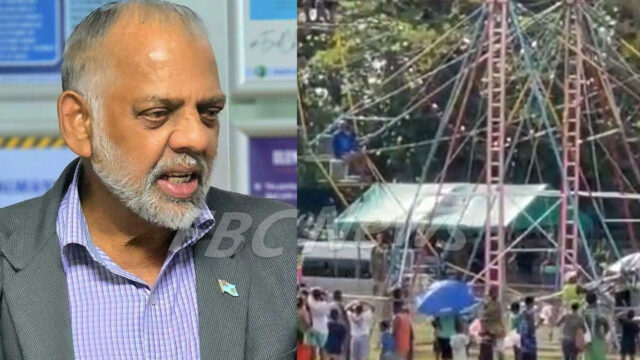

Westpac’s Pacific Economist Shamal Chand says the 2024-25 national budget attempts to address cost of living pressures through pay increments, economic stability and consolidate Government’s medium-term fiscal position.

Chand says key highlights from the budget are the increase in the national minimum wage, and the civil service pay rise.

However, Chand says while the wage relief will support disposable income, there are concerns it may further contribute towards already high prices.

He says the Government expects $3.9bn in revenue and will spend an estimated $4.6bn, resulting in a fiscal deficit of $635.5m in the next fiscal year.

Chand says to finance the deficit, the Government will borrow $298.3mn from external sources and $686.3mn in domestic bonds and loans.

Gross debt will decrease slightly to 77.8 percent of GDP by July 2025, mostly due to increase in nominal GDP.

He says the Medium-Term Fiscal Strategy released earlier in the year aimed to reduce the budget deficit to three percent of GDP, achieve a primary surplus, and target a debt level of 75 percent of GDP within next three years.

According to Chand while the 2024-25 budget mostly aligns with these goals, the Government has tweaked the numbers to balance competing demands and needs.

He says the budget is set to continue with a primary deficit of 0.7 percent in 2024-25 after breaking even in the current fiscal year.

Inflation stood at 6.7 percent last month, driven by higher prices for food, non-alcoholic drinks, alcohol, tobacco, health-related expenses, transport, and housing utilities.

The average annual inflation for the 12 months leading to June rose to 4.3 percent.

Chand adds the year-end inflation is projected to end up at a higher pace this year led by high commodity prices, freight costs, and shocks emanating from the budget’s cost of living measures.

He says Westpac Fiji maintains its 2.5 percent growth forecast for 2024, with an expected rebound to three percent in the near term as high inflation, population decline amid high emigration, underperforming primary sectors, declining construction activity and regulatory bottlenecks are offset by a robust tourism sector and surprising strong personal remittance inflows.

Key reforms announced in the 2024-25 budget are notably growth neutral..

Ritika Pratap

Ritika Pratap