BSP Life is looking at broadening its investment portfolio by tapping into large and medium scale investments.

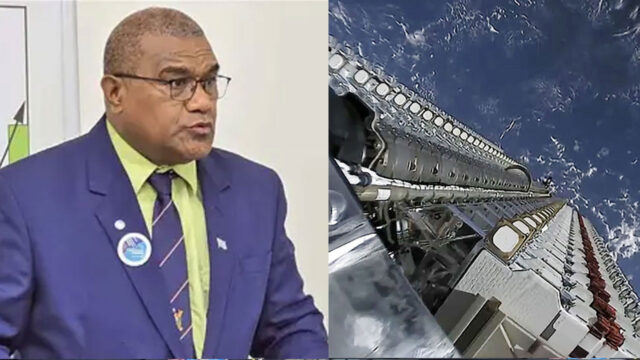

Managing Director Michael Nacola says BSP Life’s investment portfolio has almost tripled since 2010 surpassing one billion dollars last year, making it the second largest institutional investor in Fiji after the Fiji National Provident Fund.

He says the focus is now on growing the portfolio to two billion dollars whilst maintaining strong returns.

“The other very important point is a lot of the assets that we invest in provide national economic benefit. So it helps tourism. It helps us in the medical space. We also have a health insurance company that is a wholly owned subsidiary. So it helps us provide important private insurance, as well as through Oceania, provide services there that in the absence of that, we’d have to be sending people overseas. Rooster Poultry, between the two key operators in poultry, Fiji is self-sufficient.”

Managing Director Michael Nacola

Nacola says an important step for them is to move towards forming strategic partnership with local and international investors to be able to move into large-scale investment.

“Typically foreign investors get more confidence if they’re partnering with reputable local institutions. So if we can get a consortium locally, move into some of the new emerging industries and entice foreign investors to come in, that then helps Fiji’s economy, the GDP, grow at a faster rate. We can dial down our debt. We can create more employment for our people.”

Nacola says they will be making announcements on the new investment soon.

He adds the majority of investment will be done in new sectors, but they will also be expanding on their current investments at Rooster Poultry, Oceania Hospitals Pte Limited and the tourism sector.

One of the projects that has already been announced is the $230 million hotel development project in Denarau in partnership with Fiji Airways.

Ritika Pratap

Ritika Pratap